Update: March 2018

The market is very, very happy.

The fiscal stimulus and lack of major “inflation scare” is helping keep markets steady, yet trending higher on a positive note.

So here’s the wall of worry that is getting built.

Each of these is real in my opinion.

Inflation is the big one that worries the market. Interest rates are rising and the pace and degree would normally be affected by the pace of inflation. I say normally because the Fed isn’t about to turn hawkish. That is, they aren’t suddenly going to undo 10 years (yep – 2008 was 10 years ago) of policy because they suddenly want to get ahead of the inflation curve. Nope. The Fed is going to be led by the market.

Right now, the market will accept three rate hikes.

That doesn’t mean the market won’t get nervous. For example, a sudden jump in inflation will scare traders into expecting more rate hikes.

The market should worry because inflation is already here. Consider truck rates – 70% of all goods in the US are shipped by truck. This means trucking inflation affects everything.

Trucking price inflation just surged into the double digits on a contractual basis. But on a spot price basis, they hit 25% year-over-year.

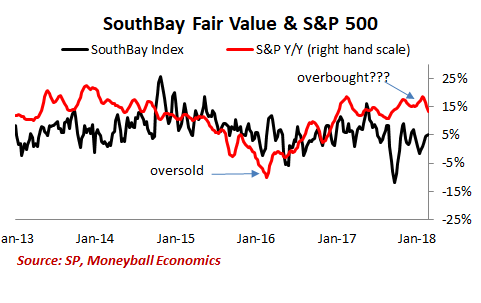

However, the market has mostly shrugged off the recent blow-off. It’s down just 3% from its recent top. Here’s another look at the revised SouthBay Fair Value Index.

The S&P is still a bit overbought, although the gap has closed a bit thanks to the blow-off in the S&P. There’s also been an improvement in conditions for the SouthBay Index.

Now, look at the S&P y/y growth rate.

Pessimism was at its peak in early 2016 when market growth slowed to -5% (actually contracting on a year-over-year basis).

Leave A Comment