Thanks to a strong monthly jobs report, the market is flying higher. The ES was up 23, the NQ was up nearly 70, and what was going on in the market one month ago today is a distant, distant memory.

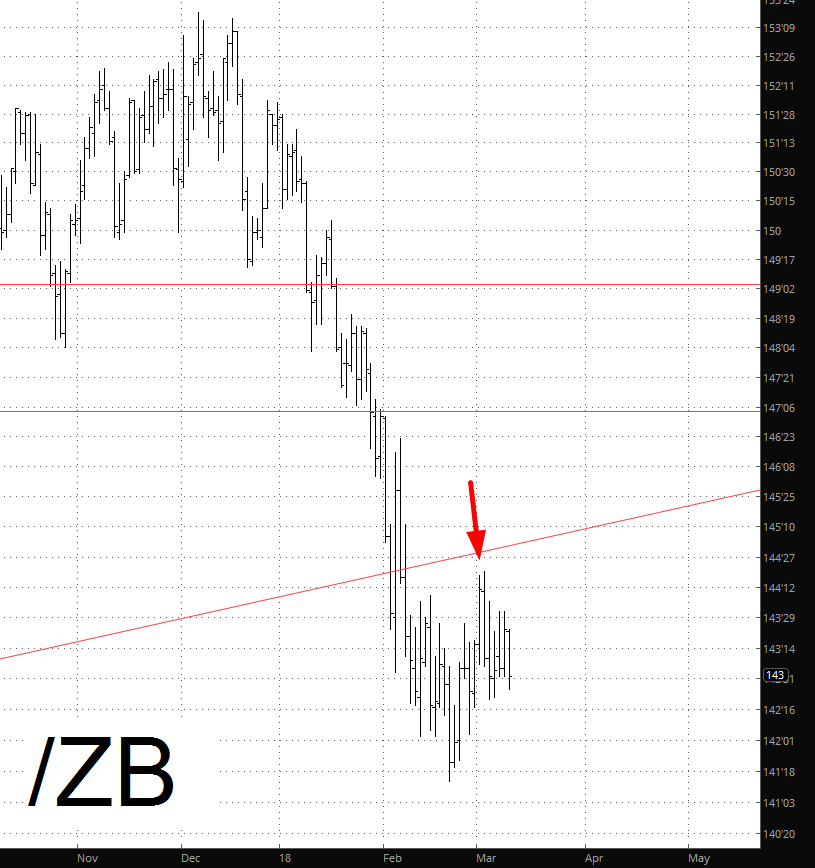

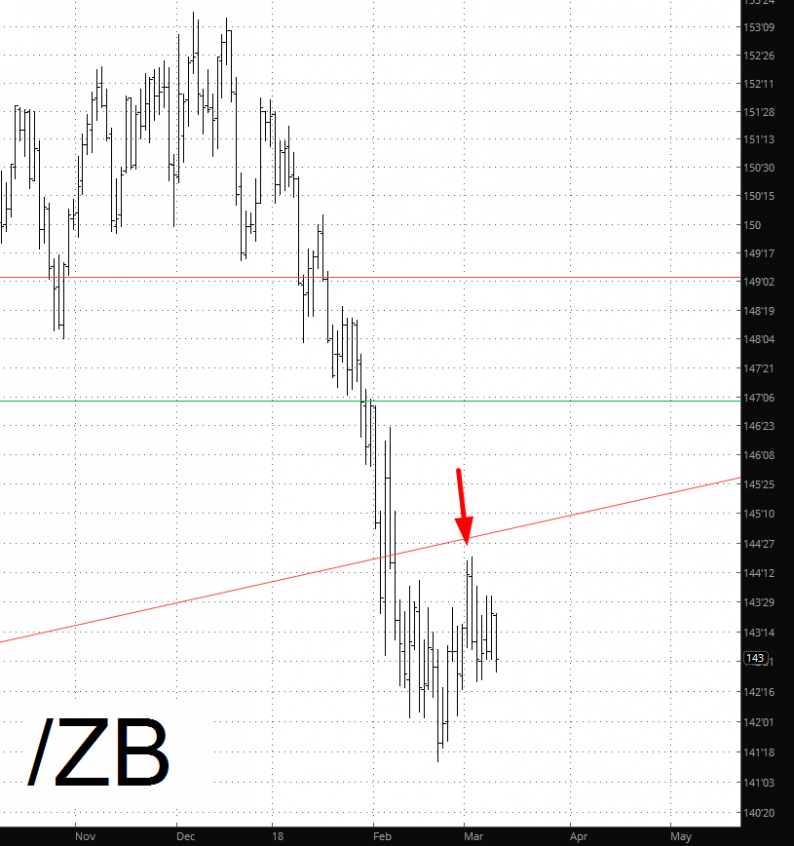

Because the economy is so strong, yields continue to strengthen (and, in turn, bonds weaken). I’ve been kind of obsessed with bonds, and they were “turned away” nicely by the trendline a bit more than a week ago. At the moment, bonds are just about the only asset in the red.

The ES is raging higher, although in the bigger picture, this may simply be the third “lower low”. Pretty much the last hope for the bears (and I hesitate to even use a plural noun) is that red line I’ve drawn. Cross that, and, well, I guess you should just buy NFLX and AMZN each and every day.

Speaking of which, the Nasdaq is much, much stronger than the ES. The NQ, shown below, is at the cusp is a lifetime high. Who knows, by the time you read this, it might have already crossed it.

My concentration continues to be “bullish interest rates”, which means short bonds and short real estate. The IYR fund, shown below, illustrates nicely how real estate keeps hitting a wall of resistance and is turned away.

Leave A Comment