Medtronic (MDT) is one of the largest medical device makers in the world and, with 39 consecutive years of dividend growth, one of the venerable dividend aristocrats here.

Even more impressive? Over the last 39 years, Medtronic has rewarded income investors with 18% annual dividend growth, making it not only highly reliable, but also one of the fastest payout growers on Wall Street.

Let’s take a look at what makes this medical blue chip stock so special and see if it’s likely to continue increasing its dividends at a double-digit clip over the coming years.

While Medtronic may not sport the yields offered by some of the best high dividend stocks here, it may represent one of the few undervalued high quality stocks in this otherwise potentially overvalued market.

Business Overview

Medtronic is one of the classic American success stories, having been founded in 1949 by Earl Bakken and his brother-in-law, Palmer Hermundslie, in a Minnesota medical equipment repair shop.

Over the past 68 years the company has grown into one of the world’s largest medical equipment device companies, with 85,000 employees now working out of over 480 locations in about 160 countries and helping to treat over 40 medical conditions and 70 million patients in 2016 .

Source: Medtronic

Medtronic acquired Covidien for roughly $50 billion in January 2015 to expand its presence in faster-growing emerging markets, bolster the size and scope of its portfolio of hospital supplies, and avoid some taxes by relocating its headquarters overseas. The deal about doubled Medtronic’s revenue and should help it gain more leverage and prominence on hospitals’ supplier lists as they increasingly look to cut costs.

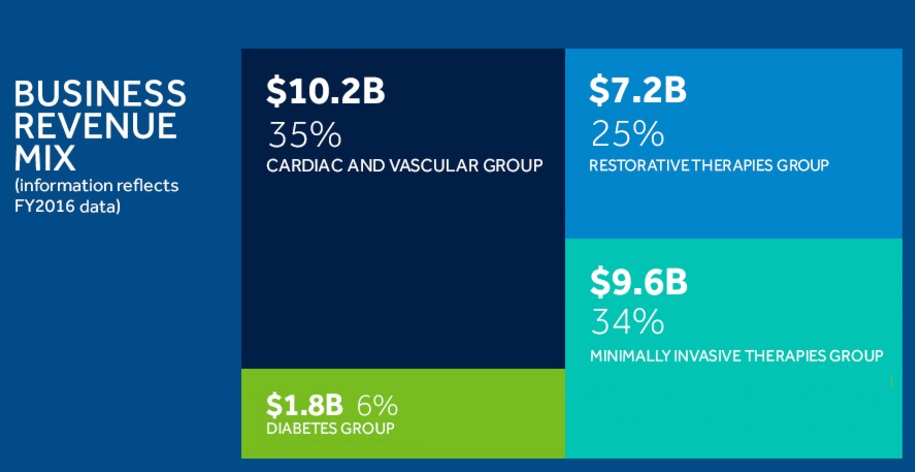

Prior to the acquisition, Medtronic was primarily known for its cardiac and coronary devices (e.g. defibrillators, pacemakers, valves, and heart stents), diabetes care, spinal fusion, and neural stimulation businesses. Covidien focused on hospital and medical supplies, equipment for surgeries (e.g. surgical staplers), and its vascular therapies.

The company’s diverse portfolio of products is organized into four main business units:

Business Analysis

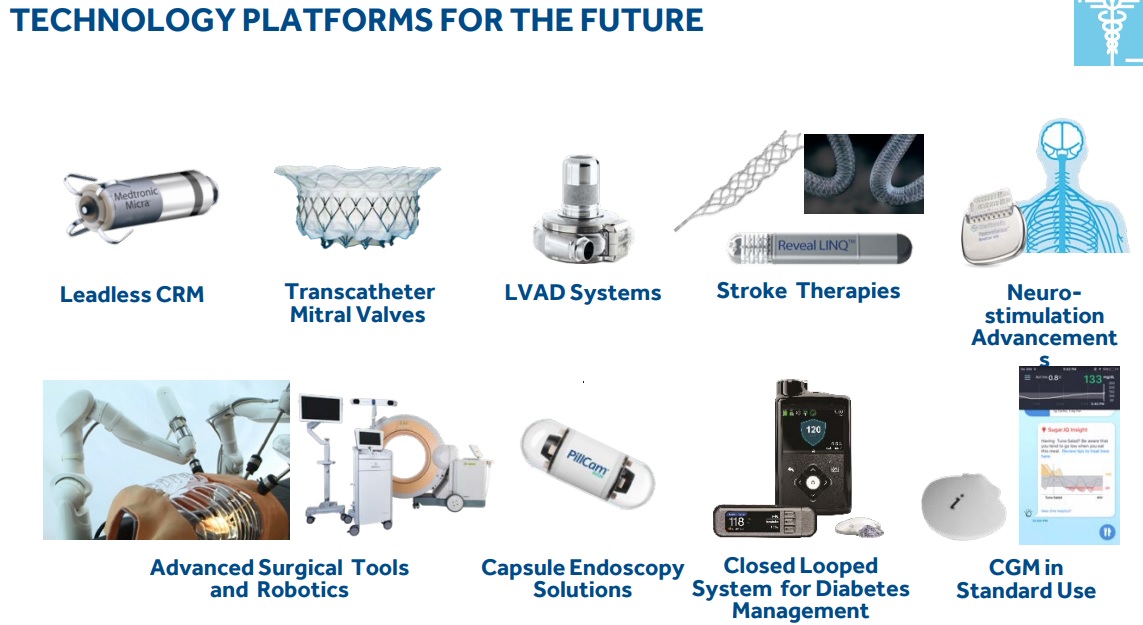

Medtronic’s success over the decades has largely stemmed from its unrelenting focus on continually innovating new medical products to meet needs of a fast-growing and aging global population.

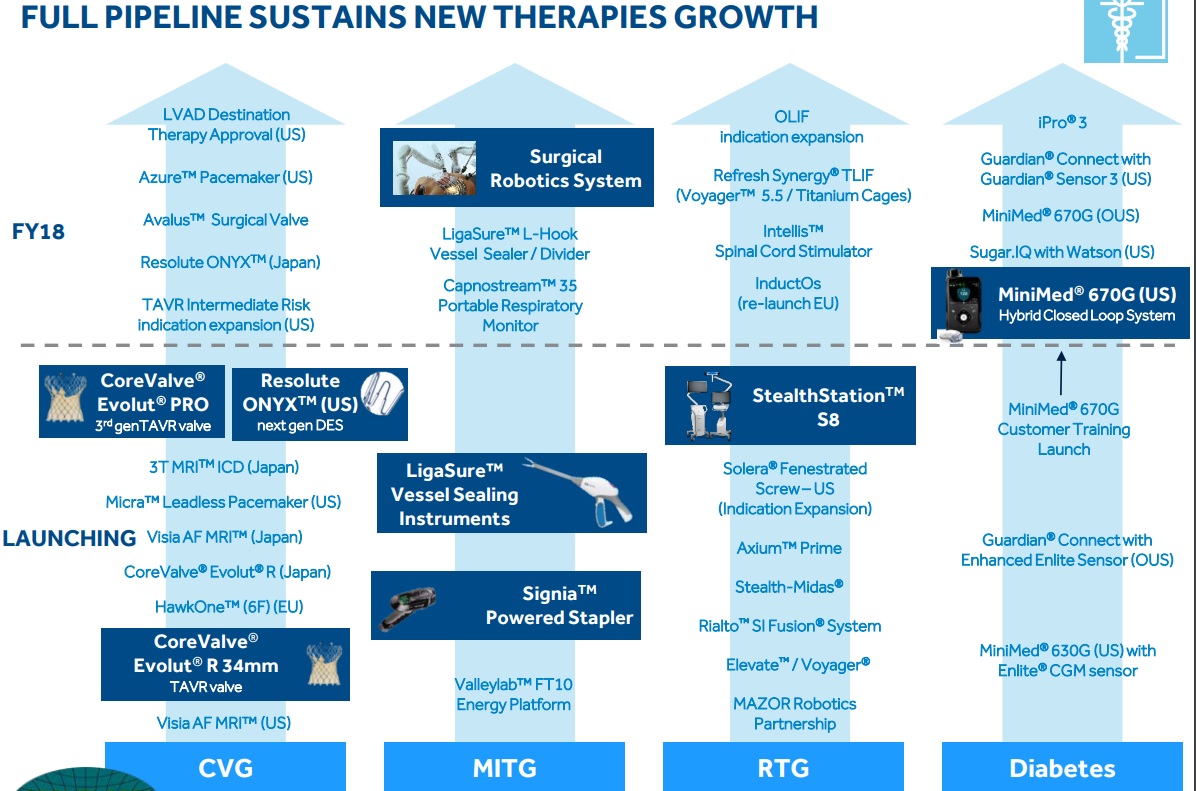

That means a rich history of large R&D spending (7.4% of revenue over the last 12 months), which has led to over 4,800 patents for world-changing inventions such as the pacemaker in 1957.

More importantly for income investors, who have been attracted to the company’s impressive dividend growth record, Medtronic enjoys a wide moat, courtesy of its quest to diversify into treating a growing range of medical conditions in its core business units, which have relatively large switching costs.

This can be seen in the company’s large development pipeline and future technology plans, which cover everything from surgical robotics systems to vessel sealing instruments.

Source: Medtronic Investor Presentation

Given the price-sensitive nature of the healthcare industry, developing successful new technologies and medical devices is essential to maintaining market share and healthy profitability.

A lot of Medtronic’s medical devices also significantly impact patients’ quality of life and must be of extremely high quality. The company’s specialized products can offer superior performance in many instances, allowing it to maintain strong market share and profitability.

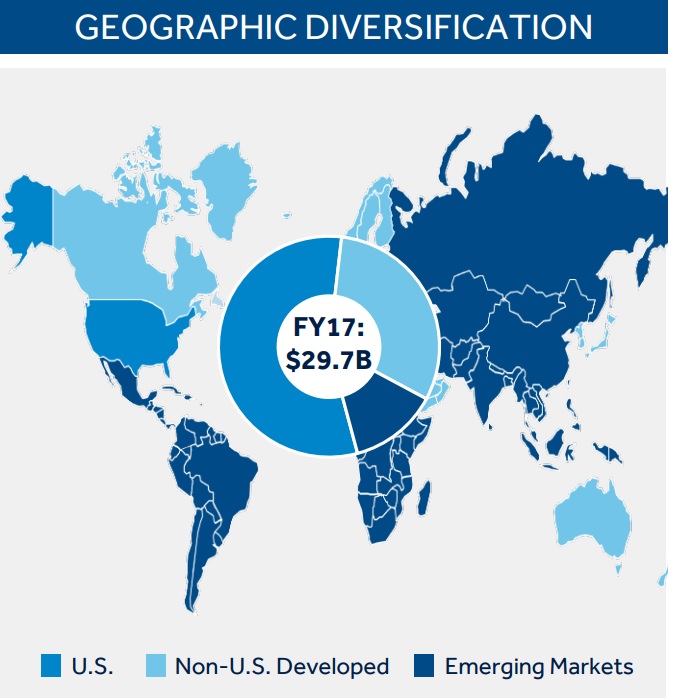

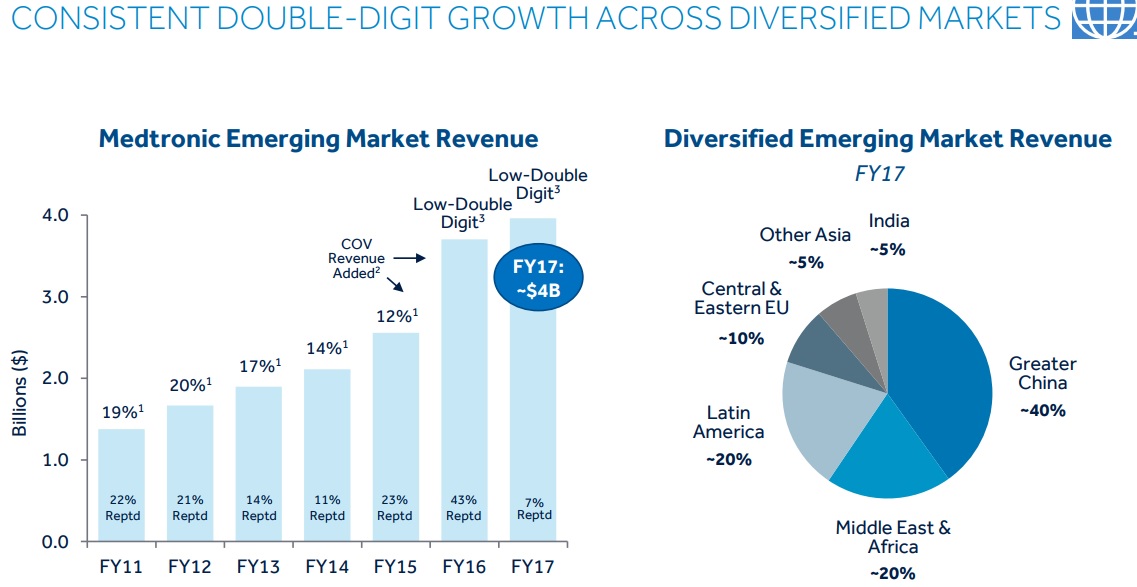

In addition, thanks to a disciplined and well executed acquisition strategy, such as its $49.9 billion acquisition of Covidien, Medtronic has been able to extend its sales reach into new promising treatment areas, as well as faster-growing emerging markets.

Just as importantly, Medtronic continues to make frequent, smaller tuck-in acquisitions to help it maintain and increase its lead in advanced medical technology.

Leave A Comment