New stock market crash inevitable

Every production phase or society or other human invention goes through a so-called transformation process. Transitions are social transformation processes that cover at least one generation. In this article I will use one such transition to demonstrate the position of our present civilization and that a new stock market crash is inevitable.

When we consider the characteristics of the phases of a social transformation we may find ourselves at the end of what might be called the third industrial revolution. Transitions are social transformation processes that cover at least one generation (= 25 years). A transition has the following characteristics:

A transition process is not fixed from the start because during the transition processes will adapt to the new situation. A transition is not dogmatic.

Four transition phases

When we consider the characteristics of the phases of a social transformation we may find ourselves at the end of what might be called the third industrial revolution.

The S curve of a transition

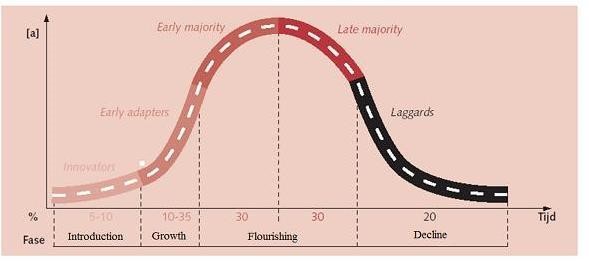

Figure: Four phases in a transition best visualized by means of an S – curve: Pre-development, Take off, Acceleration, Stabilization.

In general, transitions can be seen to go through the S curve and we can distinguish four phases (see fig. 1):

A product life cycle also goes through an S curve. In that case there is a fifth phase:

5. the degeneration phase in which cost rises because of over capacity and the producer will finally withdraw from the market.

When we look back into the past we see three transitions, also called industrial revolutions, taking place with far-reaching effect:

The emergence of a stock market boom

In the development and take-off phases of the industrial revolution many new companies emerged. All these companies went through more or less the same cycle simulataneously. During the second industrial revolution these new companies emerged in the steel, oil, automotive and electrical industries, and during the third industrial revolution the new companies emerged in the hardware, software, consulting and communications industries. During the acceleration phase of a new industrial revolution many of these businesses tend to be in the acceleration phase of their life cycle, more or less in parallel.

Figure: Typical course of market development: Introduction, Growth, Flourishing and Decline

There is an enormous increase in expected value of the shares of companies in the acceleration phase of their existence. This is the reason why shares become very expensive in the acceleration phase of a revolution.

Leave A Comment