As a follow-up to our article on New Residential at the beginning of this week, this article takes a deep dive into a variety of big risks as well as reasons to be optimistic (and we’re not only talking about the big dividend yield).

New Residential (NRZ) is a real estate investment trust (REIT), and its big 12.5% dividend yield is viewed as a red flag by some investors, and as an attractive opportunity by others. After reviewing the evolving real estate investment industry and NRZ’s opportunistic business model, this article describes a variety of big risks facing the company, and then shares multiple reasons to be optimistic. And we conclude by sharing our views on why New Residential is absolutely worth considering for an allocation within your income-focused investment portfolio.

The Industry and New Residential Are Evolving

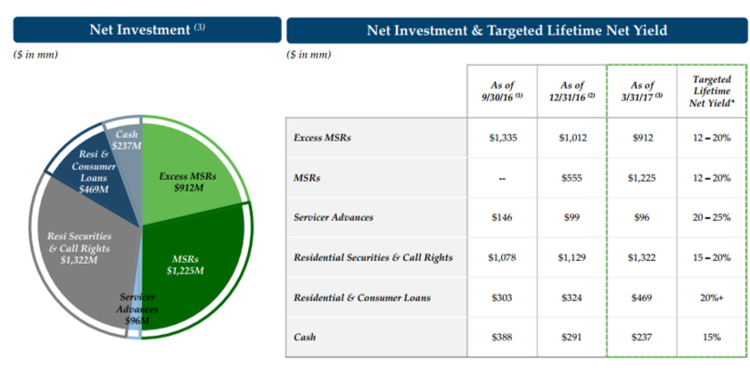

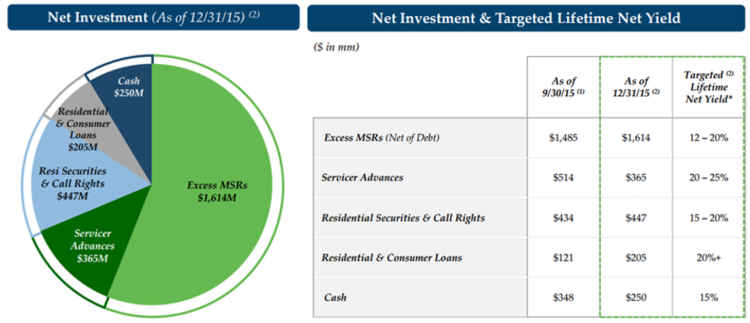

For starters, here is a look at the breakdown of NRZ’s investment portfolio now (3/31/17), followed by NRZ’s investment portfolio just 15 months earlier (12/31/15).

A few things stand out. First, the amount of Excess Mortgage Servicing Rights (Excess MSRs) has dramatically declined. Excess MSRs are basically the right to service a pool of mortgages that the primary mortgage servicer cannot handle (they’re overflow), and as you can see in the table they have very high expected returns (+12-20%) for NRZ. And especially important, MSRs and Excess MSRs tend to rise in value as interest rates rise (our current market environment) because mortgage prepayment speeds slow (people don’t want to refinance at higher rates) and this a good thing for NRZ.

However, even though Excess MSRs are lucrative for NRZ, the company is doing less of them because the industry is evolving. The Excess MSR concept took off during and following the housing crisis because the industry became increasingly complex, and NRZ was there to profit handsomely from the opportunity. However, as the housing crisis moves further into the rear view mirror, the opportunity for Excess MSR investments has slowed (less mortgages require distressed servicing), and as a result NRZ has opportunistically entered the MSR business.

In August 2016, NRZ made its inaugural full MSR purchase, and continued its momentum of investing in MSRs from multiple sellers throughout the remainder of that year, as shown in the following table.

This is an example of NRZ opportunistically taking advantage of the changing residential mortgage environment to deliver more high returns to its investors (+12-20% net yields).

Other noticeable changes are NRZ’s dramatically reduced investments in servicer advances (per our earlier pie chart). This is important because there is increasing counterparty risk with some of NRZ’s counterparties, and NRZ has proactively reduced exposure.

Further still, NRZ dramatically increased its exposure to residential securities and call rights. This reason is because the company needed to do something with all the cash it generates, and they have expertise in this area. As we’ll cover more later, there are also significant risks to these types of investments.

Again, as we mentioned earlier, the industry is changing as there is less distress as the housing crisis moves further into the rear view mirror. This means less lawsuits and more visibility into the future for NRZs service providers, and new opportunities with MSRs (instead of only Excess MSRs) and residential securities trading. And in many regards, all of this is good for NRZ as we will discuss more later.

Before getting into all of the good things about NRZ, it’s prudent to consider the risks. We have highlighted eight big risks that we believe NRZ investors should be aware of and monitoring. Here is the list:

NRZ’s Big Risks

1. NRZ is in big trouble if its mortgage servicers go bankrupt

According to NRZ’s annual report: “We rely heavily on mortgage servicers to achieve our investment objective and… It is expected that any termination of a servicer by mortgage owners (or bondholders) would take effect across all mortgages of such mortgage owners (or bondholders)… Therefore, it is expected that all investments with a given servicer would lose all their value in the event mortgage owners (or bondholders) terminate such servicer. Nationstar, Ocwen and Ditech Financial LLC (“Ditech”) are the servicers of most of the loans underlying our investments in MSRs and Servicer Advances, and Nationstar and Ocwen are the servicer or master servicer of the vast majority of the loans underlying our Non-Agency RMBS to date.”

Leave A Comment