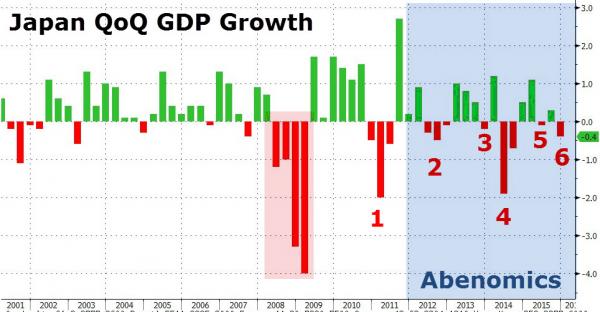

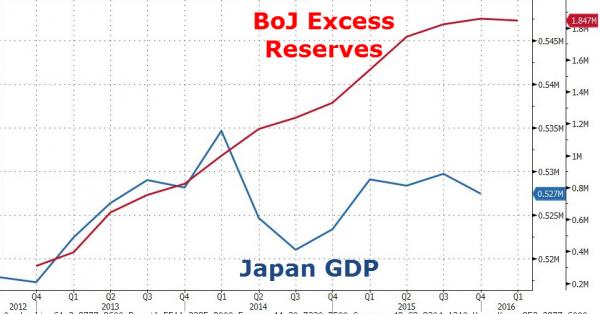

We just cannot wait for the next time either Abe or Kuroda utter the following string of words “[stimulus – insert any combination of equity buying, bond buying, money printing, and NIRP] is having the desired effect.” For the sixth time in the last 6 years, GDP growth has once again turned negative and while the BoJ balance sheet continues to balloon, so the nation’s economy (as measure by GDP) is now shrinking as Peter Pan policy is officially dead.

With 3 of the top 4 forecasters already suggesting Japanese GDP growth would be worse than the median estimate of -0.2% growth, fairy-tales were all they had left… Nearly a year ago, Bank of Japan governor Haruhiko Kuroda described the unlikely inspiration behind Japan’s unprecedented monetary stimulus: Peter Pan.

I trust that many of you are familiar with the story of Peter Pan, in which it says, ‘the moment you doubt whether you can fly, you cease forever to be able to do it’.

Yes, what we need is a positive attitude and conviction. Indeed, each time central banks have been confronted with a wide range of problems, they have overcome the problems by conceiving new solutions.

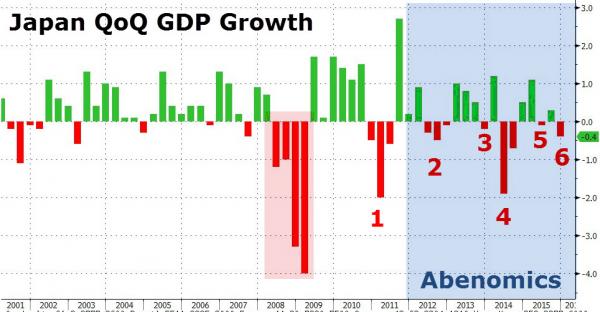

And now, Pan is dead… this is the 6th negative GDP growth period since 2010… printing a 0.4% QoQ drop against the -0.2% growth expectation…

This is the biggest SAAR GDP drop (down 1.4%) since Q2 2014 – right before Kuroda unleashed QQE2 once The Fed had left the money-printing business.

And in case anyone wanted it made any clearer just what an utter farce Abenomics has been…

But it gets much worse…

Private Consumption tumbled more than expected…

The biggest drop since Q2 2014.

Of course – if you are an “enabler” or “central planner” this is great news – just a little more NIRP and just a little more QQE and everything will be fine… what a joke!

Leave A Comment