It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the US Treasury market of all things, that it is worth the effort to try to tease out the whole story – even recognizing the likely futility of trying.

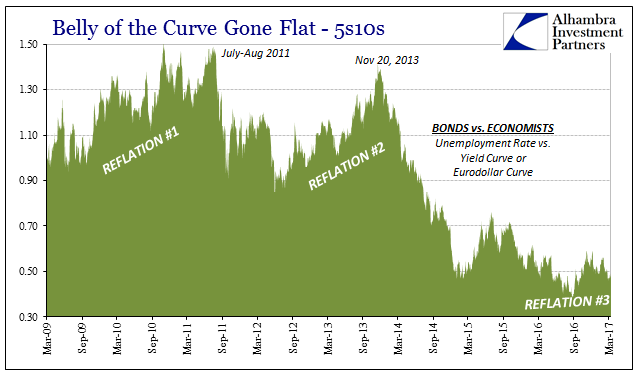

There are other days that over the past few years have offered the same level of significance as well as intrigue, where something happened as stands out in all the right charts for reasons of similarly hidden dynamics. November 20, 2013, is another, for it ended the remainder of Reflation #2 with what surely looks like a swap market massacre. There was January 15, 2015, with the Swiss being run over by “dollars”, and then August 11, 2015, also a day posing a little more clarity, though to this day not enough for my particular taste. One reason for that is June 3-5, 2015, a couple days that don’t immediately spring to mind when recalling the “rising dollar.”

It has been my own habit to start China’s “ticking clock” with August 11 that year as each of the forward cycles (if that is what they are) easily from there align with the regular 3-month intervals. I have had trouble with the period before August because it appears to be instead more like five months than three. The outward reason for the difficulty is obvious, as currency trading in CNY during those five months was, to be frank, damn peculiar.

If you analyze the chart for CNY from early 2015, however, several easily identifiable events and trends clearly stand out. For one, there was the initial phase of CNY Down = Bad during late 2014 and early 2015, where huge “devaluation” in the Chinese currency coincided with the oil crash, the (first) ruble crisis, and junk bonds (as a proxy for overall risk assets) initially getting hit. Smack in the middle of that CNY drop is the obvious prominence of January 15, suggesting that, given the direction of CNY thereafter, some sort of disturbance in global “dollar” flows from China to Switzerland were redirected by the SNB’s sudden action back to China again.

Leave A Comment