Introduction

Here is what Paul said:

We spend too much money and borrow too much money. And, actually, we’re going to bring back Obama era deficits. I was elected to combat Obama era deficits. I remember running for office and saying, we’re going to have trillion-dollar annual deficits. That’s what we’re going to have this year. So, now it’s Republicans in charge busting all the spending caps. The Democrats are complicit. Both parties, the establishment want to spend more money.

And I think part of the reason the markets are so jittery is they worry about the long-term imbalance of government debt. We have a $20 trillion debt. And we’re going to now adding a trillion dollars to it this year because of this spending deal. This is a rotten deal and not good for the — any of those of us who believe that you can get too much debt for a country to bear.

Rand Paul said the Republicans are now in bed with Democrats in caring more about increasing military expenditures than worrying about the deficit. He is correct. He is also right is saying the rapidly growing US debt is worrisome. In what follows, data is provided on why and how Paul is right and what the implications are.

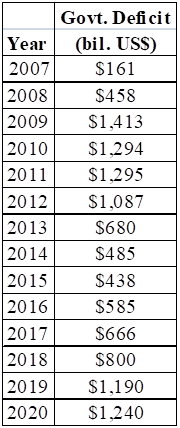

Projected Deficits

Table 1 provides data on Federal Government deficits. As was fitting, the deficit grew during the recession started in 2008 as a means to increase aggregate US demand. The deficits projected for the next few years with the country already at full employment are unprecedented.

Table 1. – US Federal Government Deficits

Source: Committee for a Responsible Federal Budget

The Right and Wrong Times for Deficit Finance

When a country is in recession, as the US was in 2009, it is entirely appropriate for governments to increase aggregate demand via deficit finance, either by reducing taxes or increasing expenditures. But the US is now at full employment. When you increase demand at full employment, several things can happen.

Leave A Comment