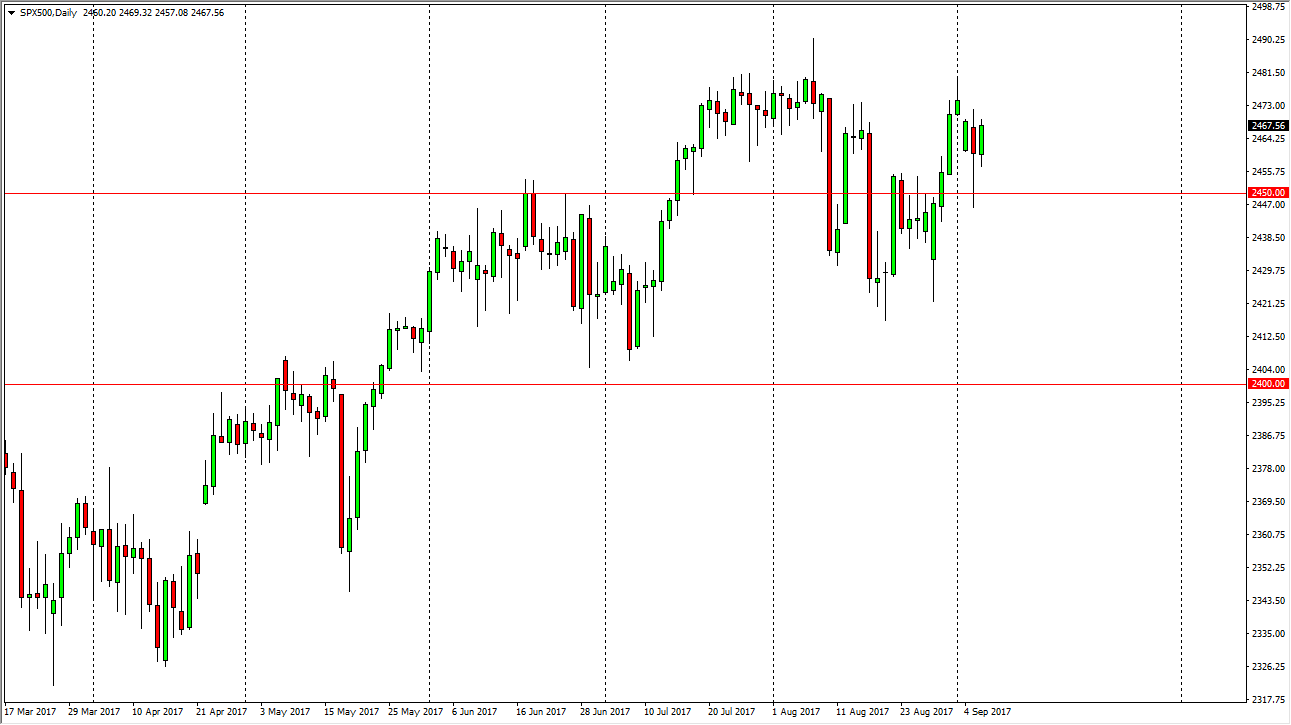

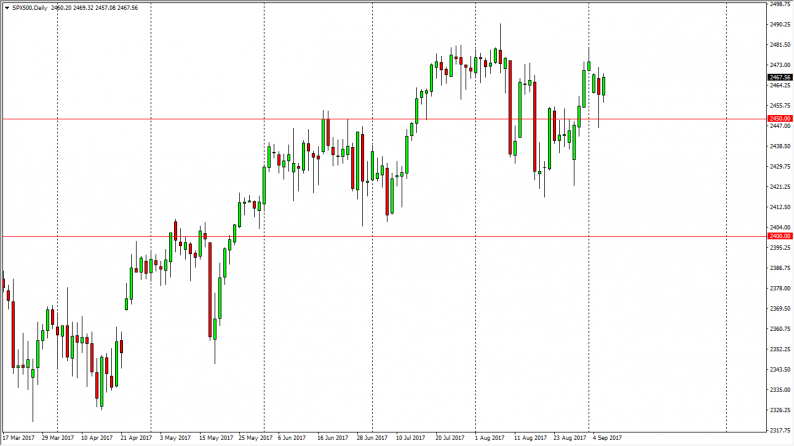

S&P 500

The S&P 500 had a slightly positive session on Wednesday, as we continue to churn above the 2450 handle. It looks as if the market is trying to find its footing to go higher, and perhaps reach towards the 2500 level. Ultimately, I think that the 2450 level underneath is going to be supportive as well, so I think that we will eventually see buyers jump into this market and push it higher. It seems as if every time we dip, the buyers come in to take advantage of value. Ultimately, this is a market that is trying to find a reason to go higher, so I think that selling isn’t much of an opportunity, and it’s likely that we will see buyers down to the 2400 level underneath. Although the market hasn’t had a substantial pullback recently, I still think that there’s plenty of buying pressure underneath.

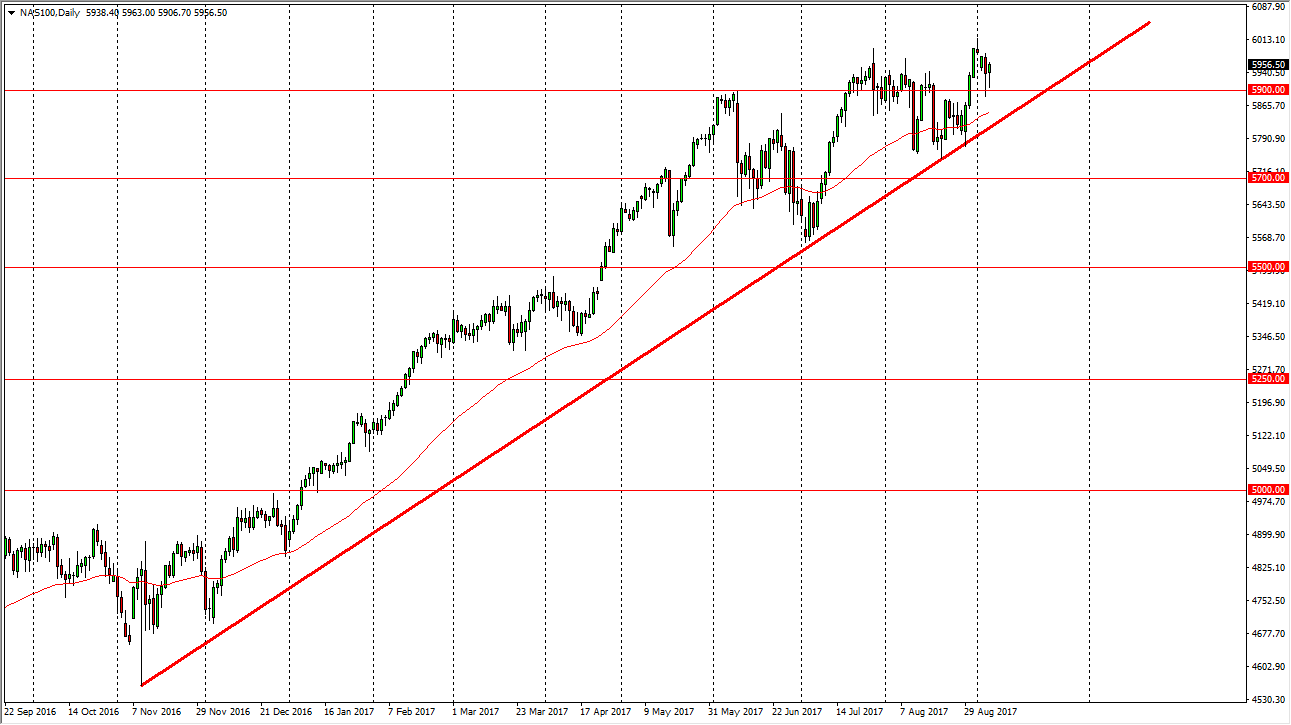

Nasdaq 100

The Nasdaq 100 initially fell during the session on Wednesday, testing the 5900 level again. We turned around to form a hammer, and that is a very bullish sign. We had formed a hammer during the previous session as well, so I think that the market will eventually find the buyers. The 5900 level has been rather important, but we also have an uptrend line that sits just below it, so I think that the market will eventually go looking towards the 6000 level again, and if we can break above there I think that the market should continue to go much higher. The Nasdaq 100 has been a leader of US stock indices in general, and I think that will continue to be the case. Ultimately, this is a “buy on the dips” market, and has been for some time.

Leave A Comment