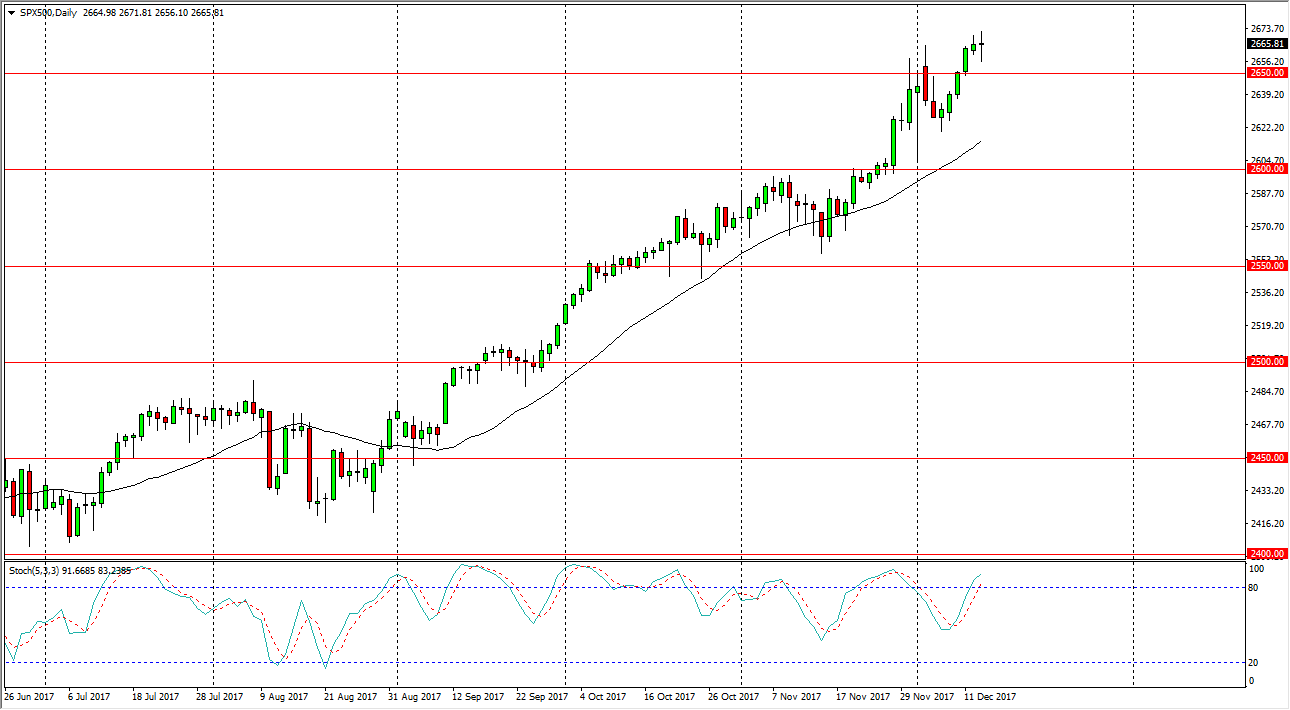

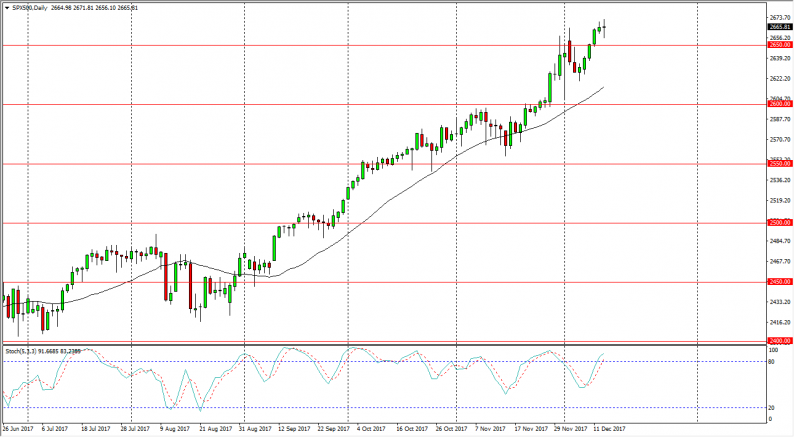

S&P 500

The S&P 500 was very noisy during the trading session on Wednesday, which is to be expected considering that we have the FOMC Interest Rate Statement coming out during the day, and of course this would have a massive influence on where markets go next. By forming a neutral candle, and essentially settling down, I believe that we are going to continue to see the 2650 level offer support, and that the market is going to grind to the upside. I think pullbacks offer value, and that the S&P 500 should go looking towards the 2700 level eventually. I think that the 2600 level is now officially the “floor” in the move higher. I believe that the Santa Claus rally should continue, so therefore I am a buyer on short-term dips.

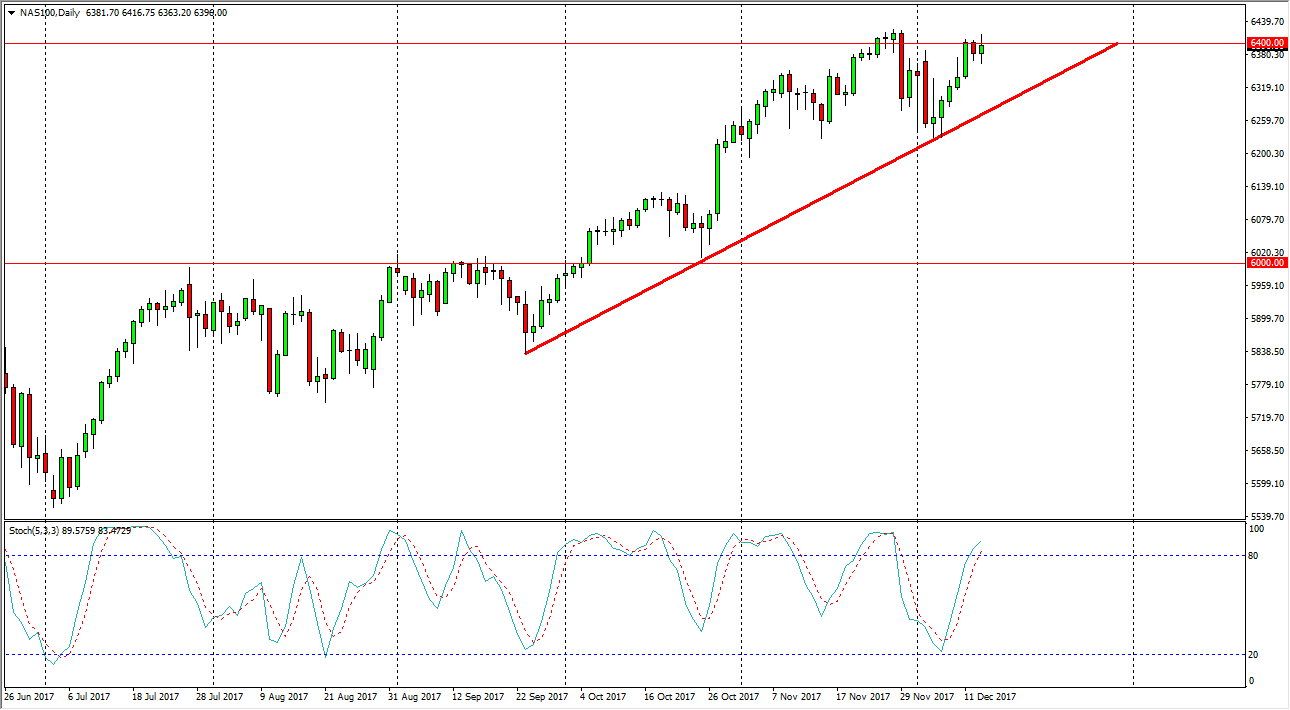

Nasdaq 100

The Nasdaq 100 went back and forth during the session as well, testing the 6400 level for resistance. A break above the top of the range for the day allows the Nasdaq 100 to continue the longer-term uptrend, perhaps reaching towards the 6500 level. That’s an area that is of massive importance due to the large, round, psychological significance of the number. We also have a nice uptrend line underneath, so I think that even if we do pullback, it will prove to be a nice buying opportunity. That being said, we are in the overbought part of the stochastic oscillator, so we could have a bit of exhaustion coming, but I look at that as an opportunity to pick up the Nasdaq 100 “on the cheap.” While this market has been lagging the other US indices, I do think that eventually it will play catch-up. I believe 6500 will be challenged rather soon, so therefore value propositions are what we should be looking for.

Leave A Comment