Salesforce (CRM) calls itself the world’s #1 customer relationship management (CRM) platform. Its purpose is to help companies understand their customers’ needs and solve problems – all on one single platform. And right now the stock is basking in the Street’s highest praise.

This is a company that “is making all the right moves, at the right time, with the right people.” These are the words of Piper Jaffray’s Alex Zukin (Track Record & Ratings) . He has just reiterated his Buy rating on the stock following CRM’s Dreamforce conference and analyst meeting. Plus Zukin bumped up his price target from $180 to a Street-high $190 (19% upside potential).

Demand is up, tangible product innovation has increased, and breadth, depth, and scope of projects and products at the company and in the ecosystem are at ‘an all-time high’, Zukin explained to investors. The conclusion: This is a stock ‘you can set and forget.’

Best-Rated Trending Stock

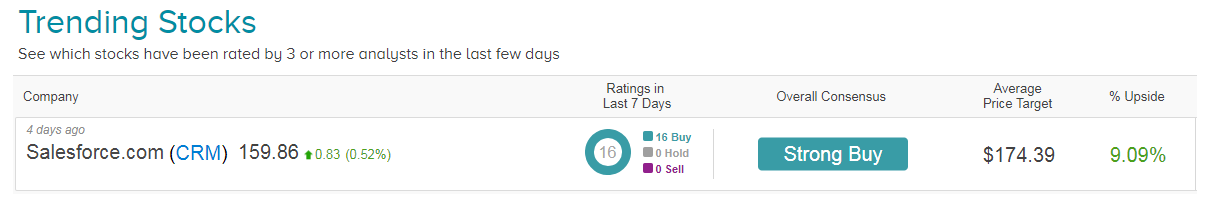

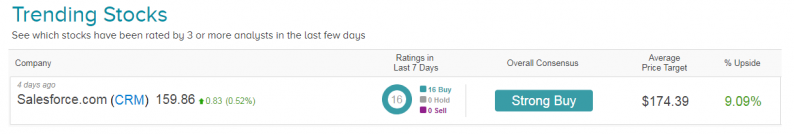

He isn’t alone. A wave of analysts have published bullish ratings on the stock in the last week, while ramping up their price targets. How do we know this? TipRanks’ Trending Stocks tool highlights CRM as one of the best-rated stocks right now:

“We leave our 10th Dreamforce with both renewed and with even stronger conviction that our bull thesis on CRM shares is not only intact, but the company remains on the path to continue its durable growth at scale” gushes top Rosenblatt analyst Marshall Senk (Track Record & Ratings).

With only 38% of the base currently running multiple clouds (while generating 92% of revenues) he spies significant opportunity for cross and upselling with significant near-term opportunities around integration and marketing. Based on the bullish tone of customers, he upped his price target from $164 to $178.

A healthy long-term outlook

Leave A Comment