Many of the most popular high yield stocks are real estate investment trusts (REITs), master limited partnership (MLPs), and business development companies (BDCs).

All of these industries are designed to pay very high dividends.

When it comes to regular corporations, however, a very high dividend yield can be a warning sign that something is fundamentally flawed with the company’s business model.

Many of these companies tend to have relatively low Dividend Safety Scores, indicating that their dividends could be at risk of being cut in the future.

Let’s take a closer look at Seagate Technology (STX), which offers a high dividend yield above 5% and has paid higher dividends for six straight years, to see if the stock could be appropriate for our Conservative Retirees dividend portfolio.

Business Overview

Founded in 1978 in Dublin, Ireland, Seagate Technology is one of the world’s largest suppliers of data storage hardware, including hard drives, solid state hybrid drives, solid state flash based drives, and memory cards.

The company’s products are found in everything from PCs, mobile phones, tablets, and digital video recorders (DVRs) to cloud computing servers.

However, Seagate’s fortunes continued to be tied to its specialty, hard disk drives (HDDs), which is the industry it helped pioneer.

HDDs are devices that store digital information on rotating disks with magnetic surfaces. They have been used in a number electronic devices such as PCs for decades.

Business Analysis

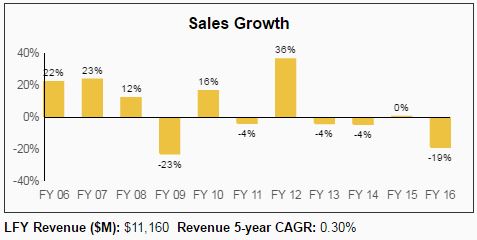

Up until recently, Seagate was flying high on the boom in demand for data storage devices.

While that demand continues to grow rampantly, the company is facing major challenges in growing its top and bottom line on two fronts.

Source: Simply Safe Dividends

First, the introduction of solid state, NAND flash memory, or SSD technology, has really cut into Seagate’s growth runway.

Unlike hard drive memory storage, which involves a physically spinning magnetic medium, solid state NAND memory has no moving parts.

This makes it more reliable (less likely to break), far more energy efficient, and also much faster to operate (instant on vs. boot up).

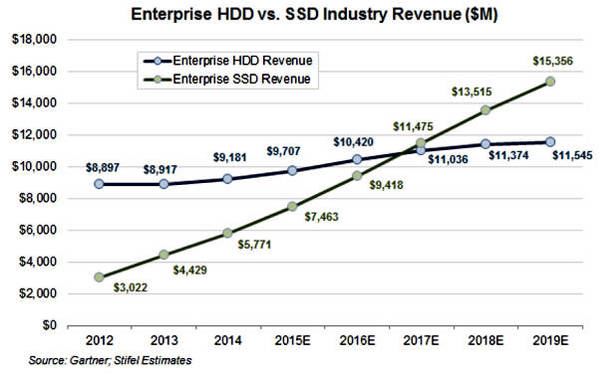

As a result, technology research firm Gartner forecast in early 2016 that enterprise SSD industry revenue could surpass HDD revenue this year.

The second major challenge Seagate has faced is that it’s operating in a fiercely competitive and highly commoditized market, one that is increasingly pressured by weakening demand for desktop computers as well.

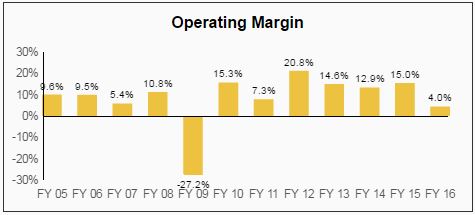

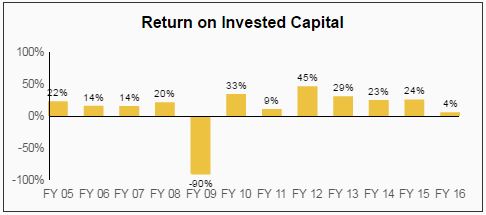

That results in weak pricing power because increasing HDD production from low-cost rivals in Asia means Seagate is in a constant battle for market share, pressuring its margins and returns on shareholder capital.

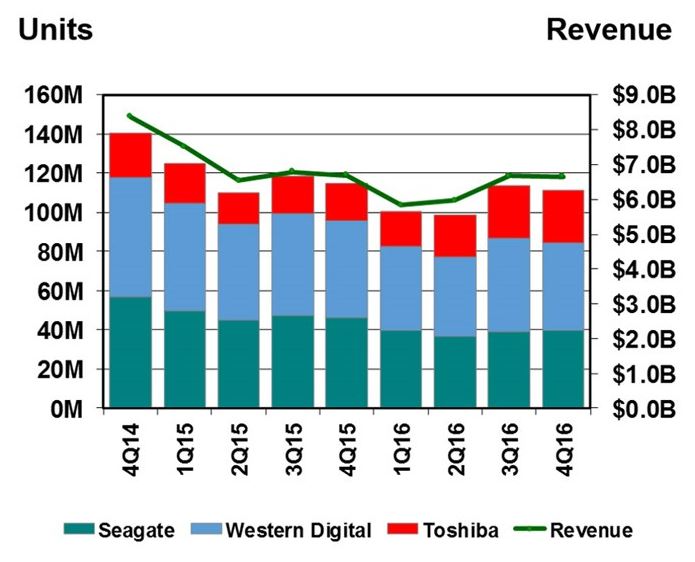

You can see that the overall disk drive market’s revenue has shrunk over the past two years, while Seagate’s market share (green bars) has also declined. Toshiba’s share gain was driven at least in part by its broad presence in both HDDs and SSDs, which makes it easier for customers to consolidate their business with one supplier.

Source: HotHardware.com

However, the news isn’t all bad for Seagate. For example, while the data storage business may have razor thin margins, Seagate has been able to generate better-than-average returns thanks to its economies of scale and aggressive cost cutting efforts.

Leave A Comment