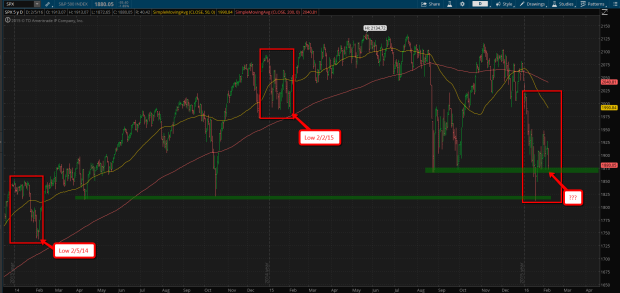

Although the beginning to 2016 has been dismal, a recent seasonal pattern may suggest that better times lies ahead. The recent “January effect” is nothing unusual, even though the declines have been greater, the last two years have also seen similar declines to bring in the new year.

In 2014, we began the year with a 6.1% decline from the highs to a low on February 5th, 2014. In 2015, we began the year with a 5.4% decline from highs to the low on February 2nd, 2015. In both cases the market continued to rally higher in April/May.

As they say, patterns are made to be broken, and two cases is hardly a big enough sample size to draw any firm conclusions. But as of Friday, as the markets remain oversold in the short term and still holding onto support (for now), it’s probably a good idea to give this pattern the benefit of the doubt until it proves otherwise.

Leave A Comment