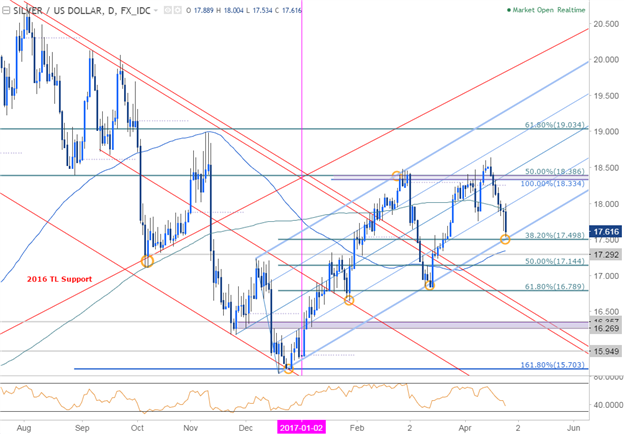

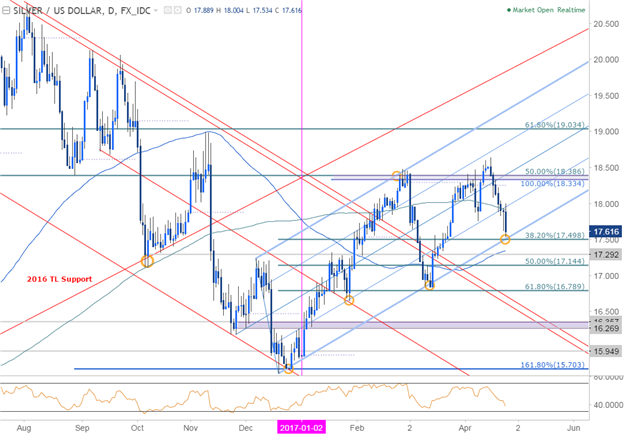

Silver Daily

Technical Outlook: Earlier in the month we highlighted the threat of a near-term turnover in silver prices with key support noted at 17.50. Since then, prices are down nearly 3% with today’s low (so far) Registering at 17.53. Note that the decline will have marked its 7th consecutive daily decline if we were to close at these levels, and while that’s not a reason to get bullish, prices are coming into an area of support and may limit the downside near-term.

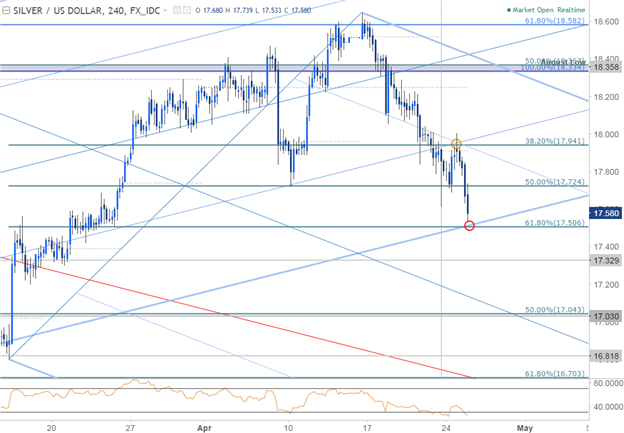

Silver 240min

Notes: A closer look at price action further highlights this near-term support confluence at 17.52– this level now also converges on the 61.8% retracement of the March advance. Near-term bearish invalidation now lowered to 17.95 with a breach above 18.33/39 still needed to put a long-bias back in control.

A break below this mark targets 17.33 – a level defined by the 1/18 swing high & the 100-day moving average- with subsequent support objectives eyed 17.03& 16.82. From a trading standpoint, I’m looking for near-term support here basically, with a rebound to offer more favorable short entries targeting a new low.

Leave A Comment