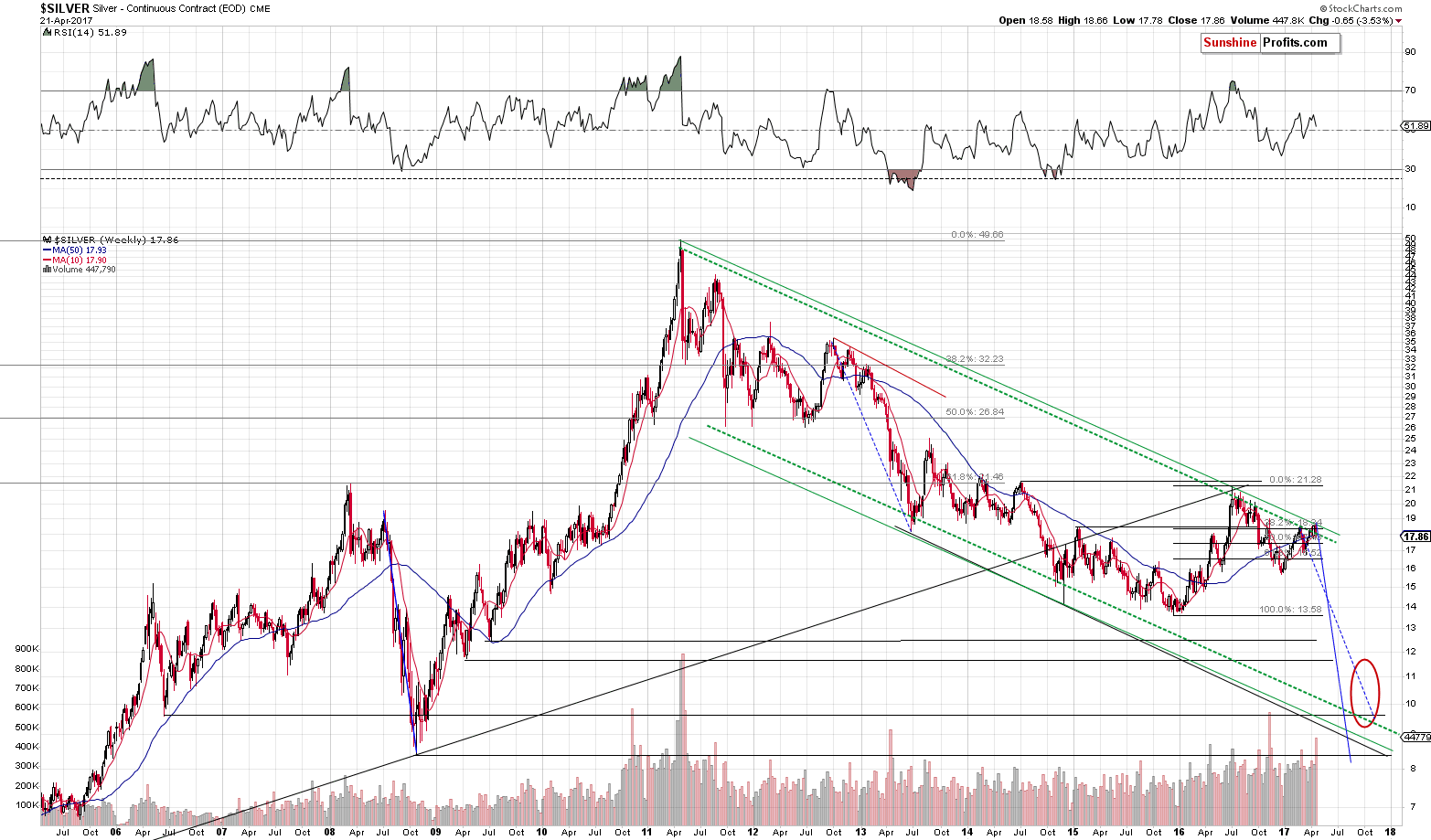

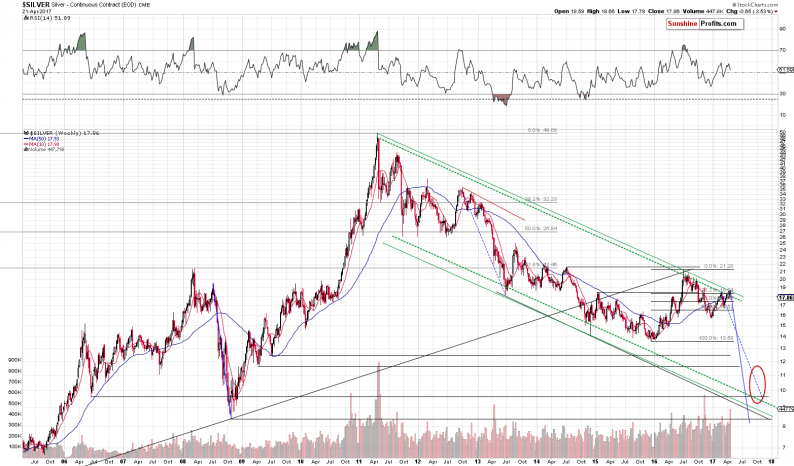

The most prominent action in the precious metals market that we saw last week, took place in silver – the white metal closed the week below the important long-term support/resistance line, thus invalidating the previous breakout. However, there’s more to the precious metals market than just the action in silver. In today’s free gold analysis, we discuss both the developments in silver and other factors.

Let’s start with silver itself (charts courtesy of http://stockcharts.com).

In Friday’s alert, we wrote the following:

(…) Still, if gold was to move higher (to $1,310 or so), then the above chart provides us with an analogous upside target – the upper, long-term green line (based on the same major tops as the lower line, but drawn through intra-day tops). It’s currently at about $18.70 – just 10 cents above this week’s high. So, the upside is quite limited.

Silver has indeed moved lower after it reached the upper of the declining, long-term, green resistance lines. The lower one (based on weekly closes) is currently at about $18, so if silver manages to close the week below it (which seems likely), the previous breakout will be invalidated and it would likely trigger another powerful decline. For now, the fact that the upper resistance line held, continues to have bearish implications – the upside is very limited and the downside is huge.

It didn’t take long for silver to slide below $18 – it did so a few hours after we posted the above and it’s been trading below it since that time. At the moment of writing these words, silver is at $17.92, so the odds are that it will indeed close the week below $18.

The volume on which silver declined was significant as well, so the implications are definitely bearish.

Naturally, if silver’s signals are not confirmed by other markets, one shouldn’t rely on them, but this time they are. In addition to multiple factors that we discussed in the previous alerts, we would like to emphasize that the breakdown in mining stocks was not invalidated yesterday.

Leave A Comment