Something big happened in the gold market. It was a stunning trend change in mainstream gold demand during the first quarter of the year. This suggests investors are becoming increasingly worried about the stock markets and are looking for safety elsewhere.

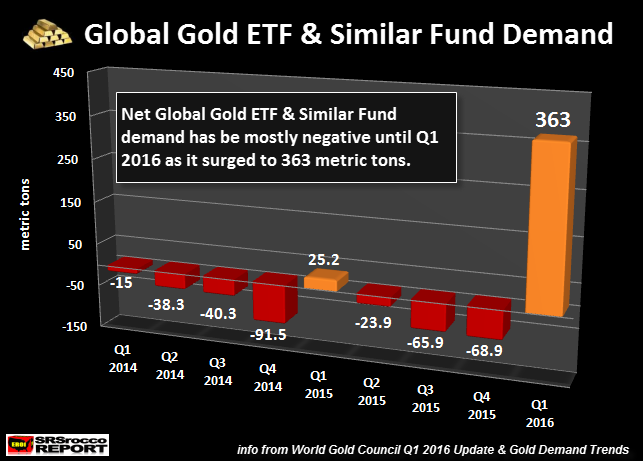

Over the past several years, the gold market has suffered net outflows of metal from Gold ETF’s & Funds. However, this changed in a big way in Q1 2016:

According to the World Gold Council’s Gold Demand Trends, the market suffered net outflows from Gold ETF’s & Similar Funds except for the small 25 metric ton (mt) build during Q1 2015. Then in the first quarter of 2016, it surged to 363 mt.Actually, it was the second highest quarterly build of Gold ETF’s & Funds in history.

The largest build of metal inventories at the Global Gold ETF’s and Funds took place in Q1 2009 when the stock markets were crashing down to their lows. That quarter, Global Gold ETF’s & Fund inventories surged 465 mt– the highest ever.

Well, there was a good reason for mainstream investors to pile into gold during this time. This was when CNBC’s Jim Cramer was telling his viewers that there was no bottom in sight as the Dow touched 6,700.Financial network talking heads just didn’t know what to say anymore as they watched what looked like a total collapse of the markets.

If you haven’t yet read the report, I highly recommend it. It shows how the ongoing trends in the gold markets point to a huge move in the future.

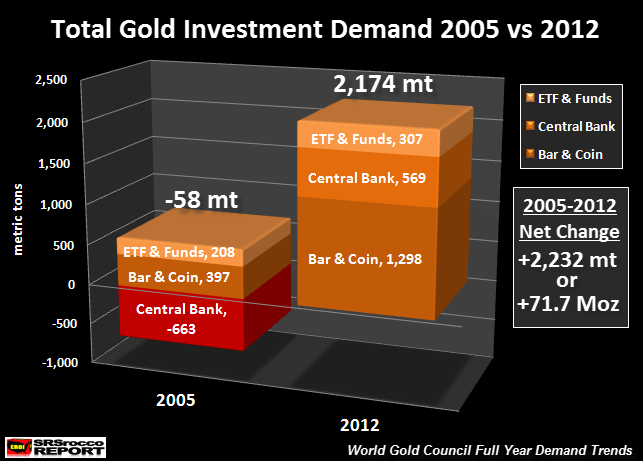

In the report, I discuss the huge change of investment demand between two peak time periods. Here is one of the charts from the report that shows just how much net investment demand has changed:

When Western Central Banks dumped 663 mt of gold onto the market in 2005, the net effect on total gold investment demand that year was a negative 58 mt. Compare that to the 2,174 mt of total gold investment demand in 2012. This was a stunning 2,232 mt (71.7 Moz) swing of total gold investment demand in 2012– versus 2005– which helped to push the price of gold up to an annual record of $1,669. Simply put: on average, various market factors have sent the price of gold on the rise.

Leave A Comment