A down week?

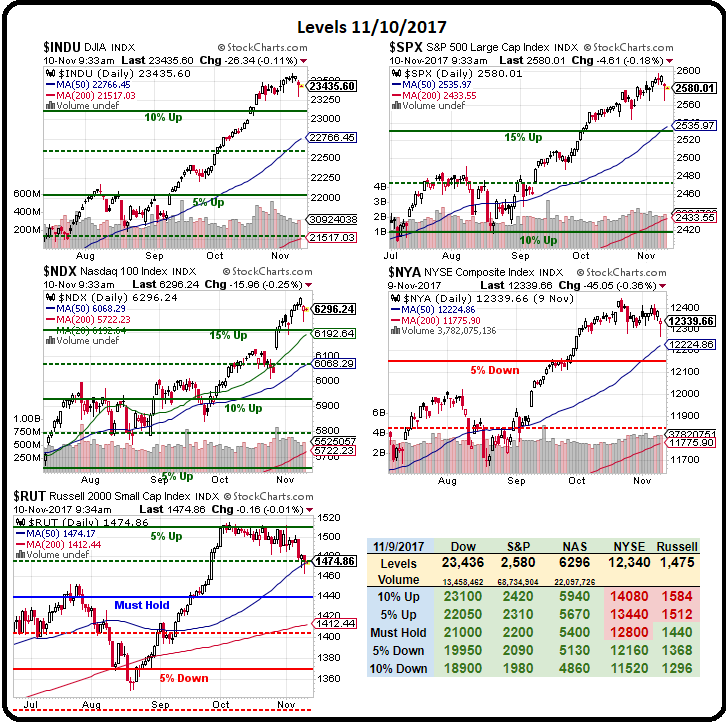

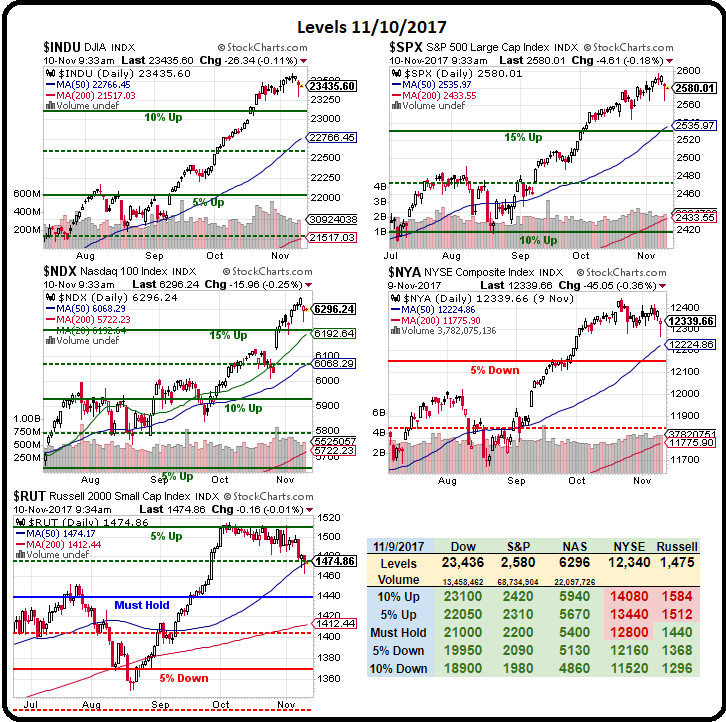

What is that? Since when do markets go lower? Well, they don’t generally (anymore) and this market hasn’t had a down week since the first week of September, when the S&P was at 2,450 so it was a nice 150-point run (6.12%) before pulling back and the 5% Rule™ says we can expect a 30-point weak retracement to 2,570 and that’s exactly what we got but 2,570 is still a 5% gain (2,572.5 actually) and, as long as that holds – it’s still bullish – just a minor correction.

As you can see (or at least extrapolate) on our Big Chart, 2,600 is the 20% line on the S&P so of course, we’re going to get a pullback there. It’s going over that line that’s going to be significant and, rather than a bearish hedge, we’re going to be needing bullish hedges to play the upside from there.

That’s right, we already have bearish hedges in our Short-Term Portfolio and our Options Opportunity Portfolio and we don’t want to get rid of those but, above the milestone S&P 2,600, we are going to want to hedge the hedges – in case the next 20% move up wipes them out and turns them into very expensive, unused insurance. When we hedge a hedge we go long the laggards – the indexes that are underperforming in anticipation that they would catch up.

We tend to take a hedge like that each quarter and, in May (19th), I was on China Global Television discussing the Brazil Crisis and we decided it was low enough to make a bullish play out of it and our trade idea at the time was:

So I like EWZ down here ($32.75) and we can take advantage of this dip with the following:

- Sell 5 EWZ 2019 $25 puts for $2 ($1,000)

- Buy 10 EWZ 2019 $25 calls for $11.50 ($11,500)

- Sell 10 EWZ 2019 $35 calls for $5.50 ($5,500)

That’s net $5,000 on the $10,000 spread that’s over $7,000 in the money to start. The upside potential is $5,000 which would be a 100% return on your money and your worst-case downside would be owning 500 shares of EWZ for net $30/share ($15,000). The ordinary margin on the short puts is just $780 so it’s a very margin-efficient play as well.

Leave A Comment