We’re going to have some fun exploring some of the trends in the average American household spending data contained within the 2017 Consumer Expenditure Survey (CEX), where we’ll start with what Americans are paying to either own a home or to rent a residence in the United States.

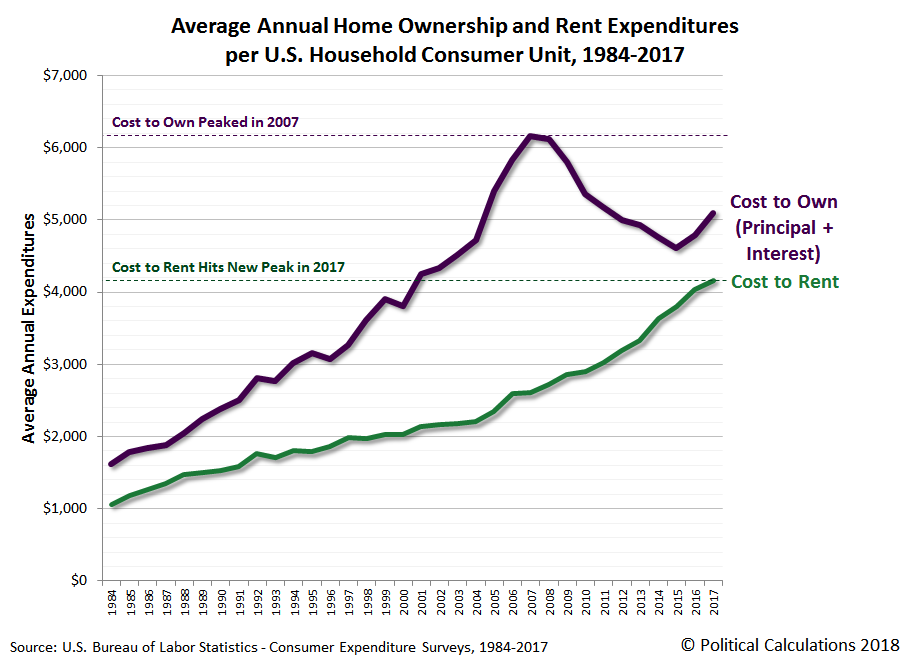

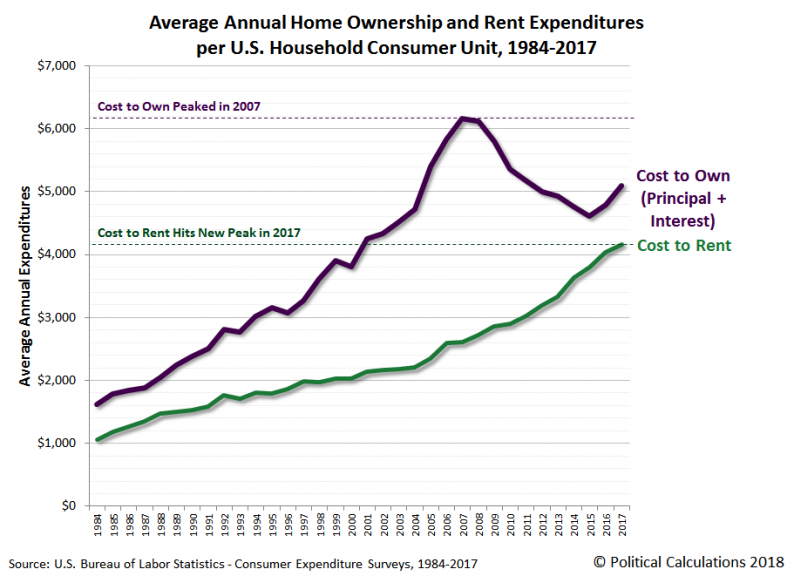

The chart below shows all the historic data recorded for the amount that all American household “consumer units” have paid on average if they’re buying a home, where they pay principal and interest on a mortgage, or if they are renting their dwelling from 1984 through 2017.

In this chart, you can see where the cost to buy a home in the U.S. rose rapidly before peaking in 2007, after which, the cost to own crashed until 2016, where it has recently started rising. Meanwhile, we can see that the cost to rent a dwelling has steadily increased without serious interruption from 1984 through 2017, where the rate at which American household expenditures for rent have grown at a faster pace since 2005 than they did in the 20 previous years.

It’s important to note here that the data reported by the Consumer Expenditure Survey is spreading all these payments out over all household consumer units in the United States. In 2017, those 130,001,000 households include 48,231,000 that pay rent and 47,129,000 that have mortgages. The remaining 34,641,000 households own homes with no mortgages, and thus have $0 expenditures for either mortgage principal and interest payments or for rent.

We can do some back-of-the-envelope math to work out what the average rent payment or mortgage principal plus interest payment is for the Americans who have these payments. In the case of rent, we can start with 2017’s $4,167 average annual expenditures on rented dwellings and multiply it by 130,001,000 households to get the aggregate amount of rent paid in the U.S. according to the 2017 CEX survey of $541,714,167,000. Dividing that amount by 48,231,000 renters gives us an annual average rent of $11,232. To get to the average monthly rental payment for the renters surveyed by the BLS and Census Bureau, we divide by 12 to find out that it is $935 per month.

Leave A Comment