Annuity.

Say the word and watch facial expressions.

They range from fear, disgust, confusion.

Billionaire money manager and financial pitchman Ken Fisher appears as the senior version of Eddie Munster in television ads for his firm.

He stares. Deep eyes ablaze with intensity. The tight camera shot. A dramatic pause, then solemnly he delivers the line:

“I hate annuities. I’d rather go to hell then sell annuities.”

Which obviously means you should too. The financial professional with a net worth of 500,000 Americans put together doesn’t need to worry much about lifetime income or portfolio principal loss. Obviously, he doesn’t believe you need to, either.

No offense but…

Let’s face it.

Ken Fisher is a master marketer. There’s no doubt of his prowess to pitch his wares. He’s raised megabucks for his firm. However, what he knows academically about annuities and how they mitigate life expectancy risk can fit in to a dollhouse thimble. And that’s fair because he doesn’t need to worry about running out of wealth. You most likely do.

Based on past comments he made in print about the financial planning industry, deeming it ‘unnecessary,’ I understand why he isn’t a fan of anything or anyone but himself. If you’re close to retirement or in retirement income distribution mode, you will pay for his overconfidence.

Unfortunately, what Ken Munster (I kid), is correct about is you as a consumer and investor must be skeptical of annuities as they are customarily offered. As they ‘sold first and planned for later.’

An annuity solution shouldn’t be on the radar until holistic financial planning is completed to determine whether there’s longevity risk – a strong probability of an investor outliving a nest egg. Annuities, especially deferred and immediate income structures, take the stress off a portfolio to generate lifetime income and places that risk with insurance companies. Fixed annuities that allow owners to participate in the upside of broad stock market indexes can be used as bond replacements.

Respected Professor Emeritus of Finance at the Yale School of Management and Chairman, Chief Investment Officer for Zebra Capital Management, LLC Roger G. Ibbotson, Ph.D., in a comprehensive white paper released last week, outlined how fixed indexed annuities which provide upside market participation and zero downside impact may be attractive alternatives to traditional fixed income like bonds.

In an environment where forecasted stock market returns may be muted due to rich valuations and bond yields still at historic lows, FIAs eliminate downside stock market risk and offer the prospect of higher returns than traditional asset classes. Ironically, at our Clarity investment committee two weeks ago, one of our partners, Connie Mack showcased a similar strategy based on our organization’s lowered return projections for traditional stock and bond portfolios.

Per Roger Ibbotson:

“Generic FIA using a large cap equity index in simulation has bond-like risk but with returns tied to positive movements in equities, allowing for equity upside participation. For these reasons, an FIA may be an attractive alternative to (long-term government bonds) to consider.”

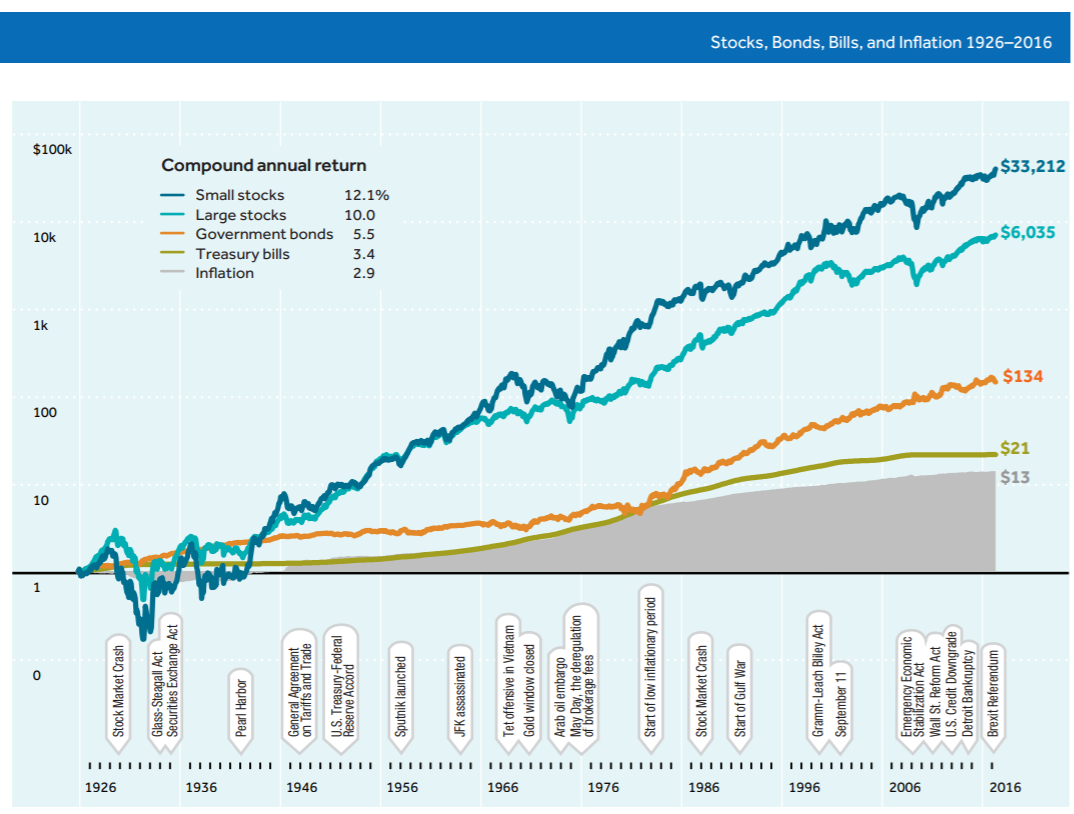

In financial services, Ibbotson is a god. Brokers and advisors have been misrepresenting to consumers his seminal chart of 100-year stock market returns for as long as I’ve been in the business. The chart outlines how domestic large and small company stocks compound at 10-12% and beat the heck out of bonds, bills, and inflation; financial professionals showcase the lofty past returns and convince customers that without buying and holding stocks for the long-term (whatever that is), they’ll succumb to the vagaries of inflation. Adhere to the chart and your portfolio will have it made in the shade! (if invested in stocks for 100 years plus).

In all fairness to Roger Ibbotson, it’s not his fault that his data and graphics have been used to seduce investors to bet their hard-earned wealth on investment fantasy. He’s been in favor of annuities in retirement portfolios and in accumulation portfolios leading up to retirement for a long time.

Investment fantasy:

Investor reality:

It took nearly 14-years just to break even and 18-years to generate a 2.93% compounded annual rate of return since 2000. (If you back out dividends, it was virtually zero.) This is a far cry from the 6-8% annualized return assumptions promised to “buy and hold” investors and the 10-12% promised by financial pros who misrepresent Ibbotson’s work.

Investors if lucky, have 20 years to save interrupted. As labor economist and nationally-recognized expert in retirement security professor Teresa Ghilarducci shared with us recently on the Real Investment Hour – “Life has a way of getting in the way.”

I have yet in my 28 years in the business to meet a Main Street investor who’s achieved or achieving the long-term returns displayed in Ibbotson’s chart. The information is correct; how it’s used to sucker investors into “buy & forget” portfolios regardless of valuations and market cycles is unfortunate.

Leave A Comment