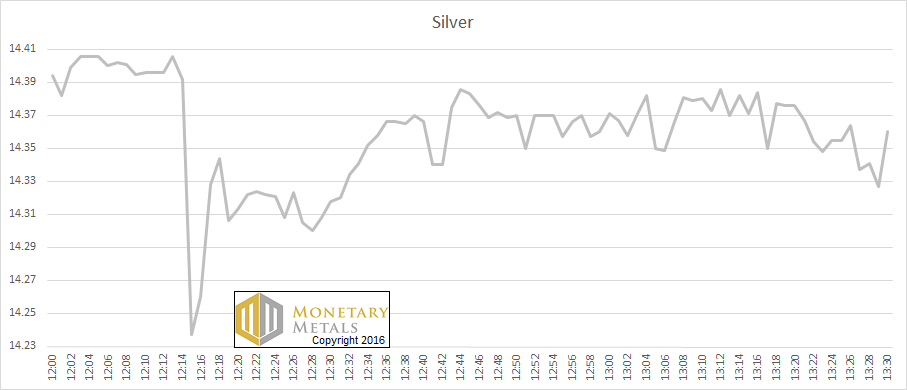

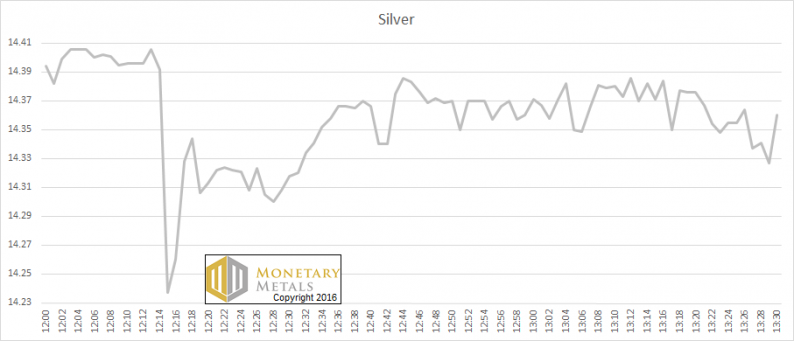

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action.

The Price of Silver, Jan 28 (All times GMT)

If you read more about it, you will see that there was an irregularity around the silver fix. At the time, the spot price was around $14.40. The fix was set at $13.58. This is a major deviation.

Many silver bugs are up in arms about how unfair the new silver fix is. That’s nothing new. They were up in arms about the old one. The old one was supposedly manipulated.

One thing is for sure, tactical manipulations can occur. A gold trader in London was found to have pushed the price down in the gold fixing by a few pennies. He had sold a multimillion dollar option, and he wanted it to expire worthless to avoid having to pay. Right after the fix, he bought back the gold he sold, pushing the price back up to where it was. He took a loss on the round trip of the gold, of course, but saved millions on the option which he did not have to pay.

This is not the long-sought proof that nefarious forces are keeping gold from attaining $20,000.

Anyways, because the silver and gold fixes were deemed to be benchmarks by regulatory changes post the LIBOR manipulations, a new process for the gold and silver fixes was implemented. Before we look at what changed, let’s consider why there is a fix price. Couldn’t they just take the price at 12:00 noon?

No, it wouldn’t work because in a live market there is not just one price. There are always two prices: bid and offer. Which would you use as the benchmark? Either price could misrepresent the current state of the market. What’s more, those prices are just quotes, not executed trades.

To be useful as a benchmark—a price that third party contracts and derivatives can be based on—there has to be a single price based on real executed trades. So they need to get buyers and sellers together, and find the price at which the most metal clears. If there is a better way than that, it hasn’t been discovered yet.

This leads to a question. How do two prices that are supposed to track each other actually, you know, stay matched? This occurs in Exchange Traded Funds that move with an index of stocks (such as SPX or GLD). It occurs in gold futures and spot.

It should also occur between the fixing process and the spot market. What use is a silver fix at $13.58 while the spot price was $14.40? We’ll get back to market action on that day, in a bit. First, we need to look at the force that keeps two prices close to each other.

Leave A Comment