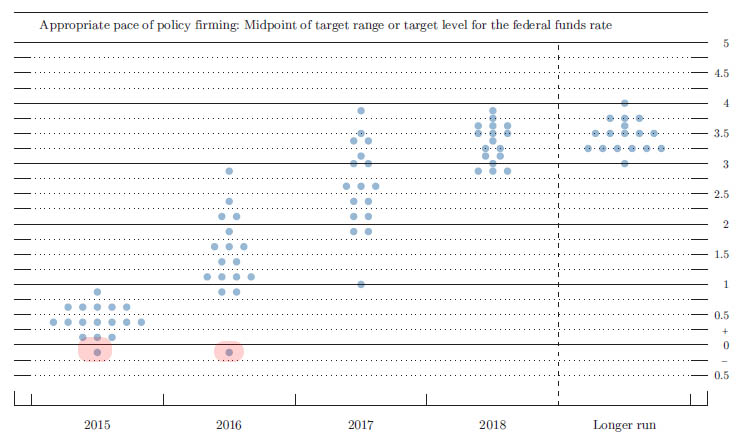

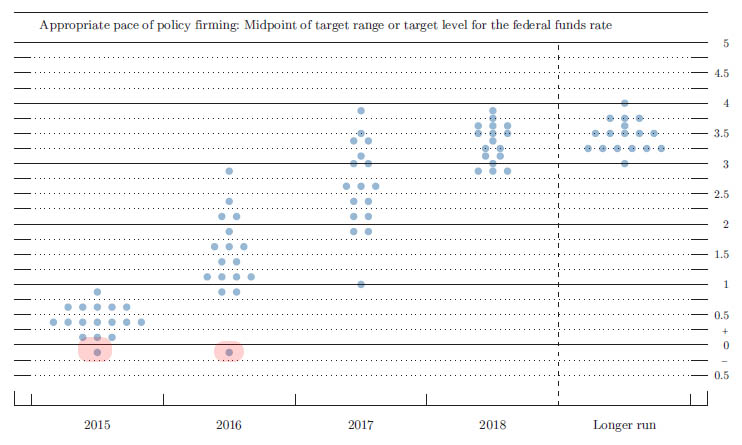

As reported earlier, the biggest stunner bar none in today’s FOMC announcement, was the emergence of a negative interest rate dot in the Fed’s projections. It was unclear who drew that (perhaps Kocherlakota, perhaps not)…

… but the author is ultimately irrelevant: what is very relevant is the “inception” of NIRP in the heads of the FOMC members, which came at a time just when everyone was supposedly gearing up to boost rates by a meager 25 bps, further raising questions if the US economy is already in recession (spoiler alert: yes).

Of course, this should come as no surprise to our readers: just in January we wrote “Get Ready For Negative Interest Rates In The US”, but for the Fed to admit this possibility just when it was widely expected to at least signal a rebound in the economy with the tiniest of rate hikes, or at worst a hawkish statement, was truly a shock.

So besides a red dot on the dot plot, what else do we have to go on? Not much, though luckily one reporter did ask Yellen what the NIRP dot signaled. This is what she said:

Let me be clear that negative interest rates was not something that we considered very seriously at all today. It was not one of our main policy options

The proverbial “we did not seriously consider it today” fluff. Remember when the SNB promised the Euro-Franc peg was safe and sound “today”, and the very next day it crushed countless FX traders who were long the EURCHF? Kinda like that.

And yet…

I don’t expect that we’re going to be in a path of providing additional accommodation. But if the outlook were to change in a way that most of my colleagues and I do not expect, and we found ourselves with a weak economy that needed additional stimulus, we would look at all of our available tools. And that would be something that we would evaluate in that kind of context.

And there you have it: not if but when the inevitable inventory accumulation spills over and results in the next recession, we now know the simple choice that is facing the Fed: QE 4 (or 10 if the Fed goes “Windows”) or NIRP.

Leave A Comment