Jeremy Corbyn, leader of the Labour Party

UK Traders Waiting Once Again

Nearly a year on from the UK’s Brexit referendum, markets are once again bracing ahead of a key UK vote. On Thursday, the British Public will take to the polls to elect its Prime Minister, and the decision could have dramatic consequences for the British Pound. Below we map out three potential scenarios which could play out.

Base Case Scenario

The most likely outcome is that the Conservative party is returned to government, though with a diminished majority. Polling results over the last two months have consistently reflected a narrowing of the Conservative party’s lead over Labour, with some recent polls even putting Labour ahead.

Sterling initially rallied in response to PM May’s announcement of a snap election, reflecting the market’s interpretation that the decision was a show of strength by May. Investors anticipated that the Conservatives would win the election easily, with a strong majority, strengthening the Conservative government and bolstering May’s bargaining power for the upcoming Brexit talks. Conservative Party victories have tended to fuel Sterling strength historically, and given the uncertainty surrounding Brexit, continuity at this stage would be seen as beneficial for the economy and the UK currency.

As polling results have shown the Conservative party’s lead narrowing over the course of the campaign, Sterling has weakened, reflecting growing uncertainty regarding the prospect of a diluted Conservative majority which would reduce May’s chances of passing her proposed policies, such as lower corporate taxes.

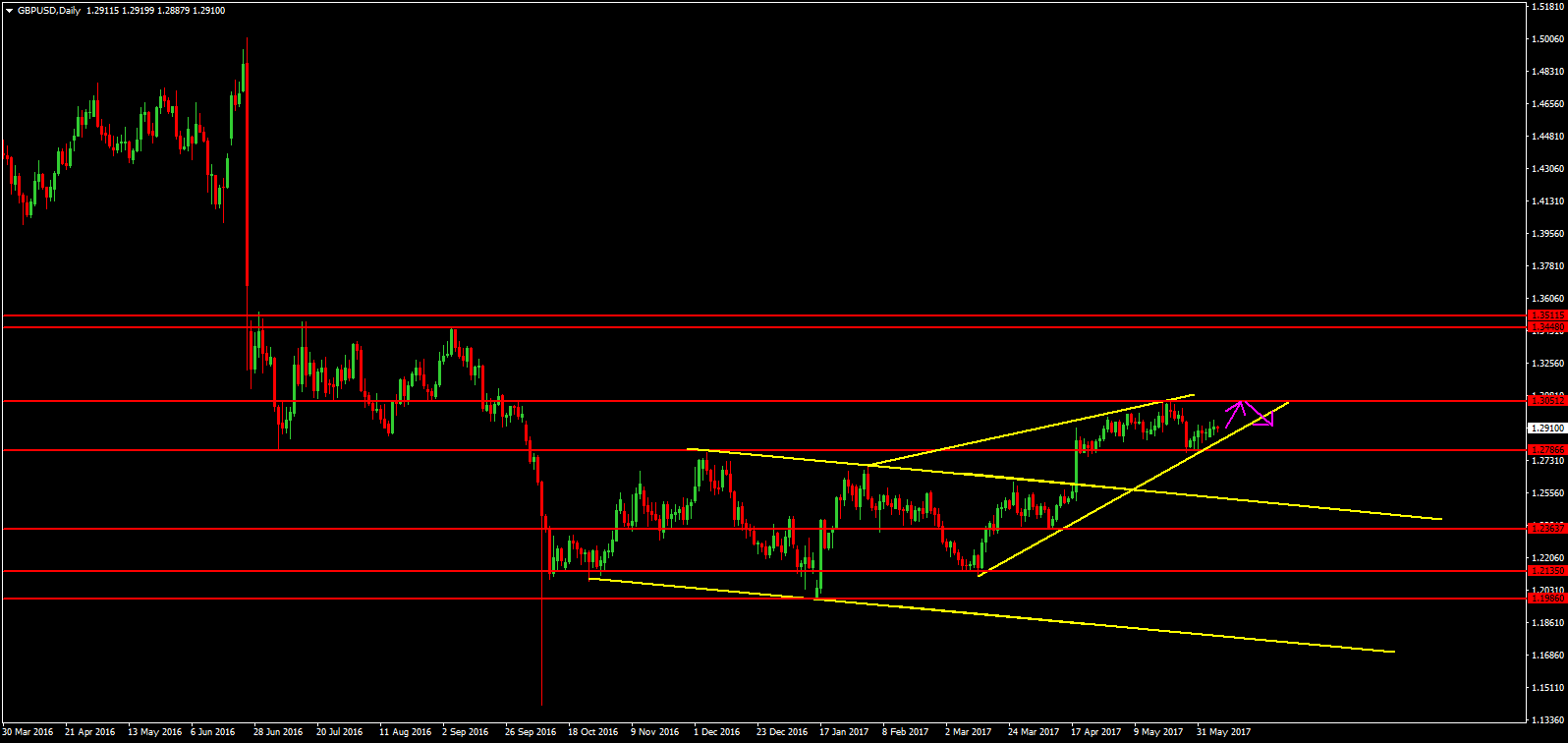

In the event of a Conservative victory, with a reduced majority, GBP is likely to see a small relief rally though given the likelihood that a Conservative victory is priced in, GBPUSD is unlikely to extend above the local 1.3045 high and the current range (1.27s – 1.30s) should persist.

Conservative Victory with Strong Majority

Leave A Comment