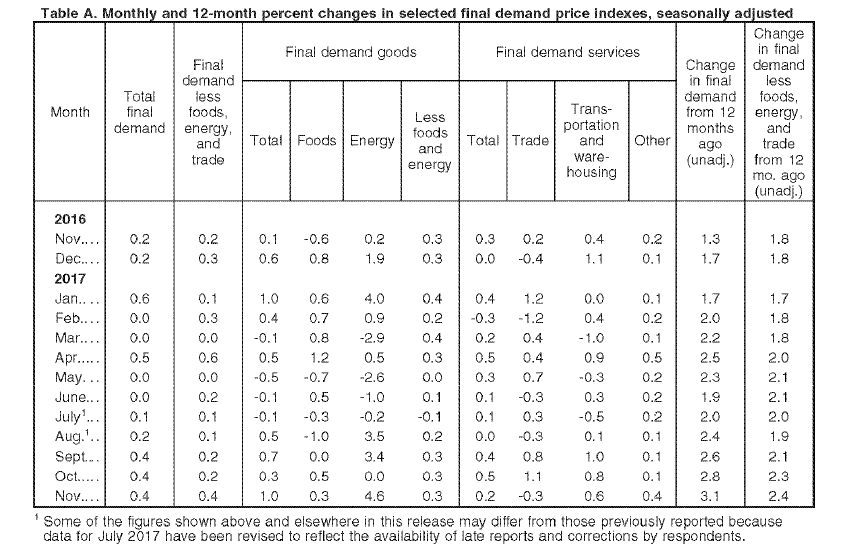

US Producer Prices beat across the board this morning with the biggest headline being a 3.1% YoY surge in Final Demand – the biggest jump since Dec 2011.

The index for final demand goods jumped 1.0 percent in November, the largest advance since a 1.0-percent increase in January. Over three-fourths of the broad-based November rise can be traced to prices for final demand energy, which climbed 4.6 percent.

Over two-thirds of the November increase in the index for final demand goods is attributable to prices for gasoline, which jumped 15.8 percent. The indexes for light motor trucks, pharmaceutical preparations, beef and veal, residential electric power, and jet fuel also moved higher. In contrast, prices for processed young chickens fell 5.7 percent. The indexes for ethanol and commercial electric power also declined.

About half of the November rise in the index for final demand services can be traced to prices for loan services (partial), which increased 3.1 percent. The indexes for traveler accommodation services; health, beauty, and optical goods retailing; food and alcohol retailing; chemicals and allied products wholesaling; and apparel, footwear, and accessories retailing also moved higher. In contrast, margins for machinery and equipment wholesaling declined 1.9 percent. The indexes for fuels and lubricants retailing and for bundled wired telecommunication access services also fell.

While surging energy costs played their part, we note a huge jump in prices for loan services, which makes for an uncomorfortably vicious circle of rising cost of living covered by increasing demand for payday loans, leading to an increased cost of living, and so on…

Leave A Comment