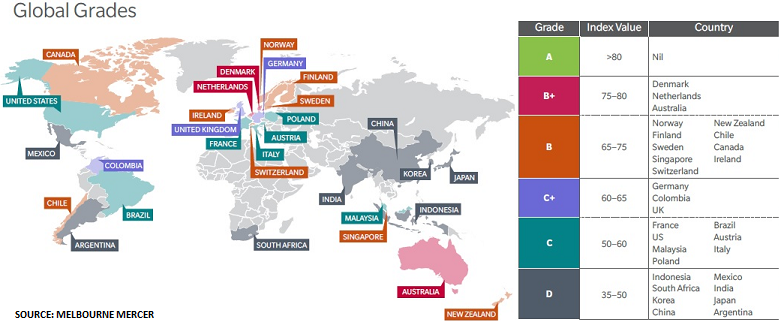

No country in the world now has a top quality pension system. That’s the conclusion from the latest Report by pensions consultants Melbourne Mercer. As the chart above shows:

Unsurprisingly, the cause of the problems is today’s ‘demographic deficit’, as the authors highlight:

“The provision of financial security in retirement is critical for both individuals and societies as most countries are now grappling with the social, economic and financial effects of ageing populations. The major causes of this demographic shift are declining birth rates and increasing longevity. Inevitably these developments are placing financial pressure on current retirement income systems. Indeed, the sustainability of some current systems is under threat.”

These problems have been building for years, as politicians have not wanted to have difficult conversations with voters over raising the retirement age. Instead, they have preferred to ignore the issue, hoping that it will go away.

But, of course, problems that are ignored tend to get worse over time, rather than go away. In the US, public pension funds saw their deficits jump $343bn last year to $3.85tn – making it almost certain that, eventually, pension benefits will have to be cut and taxes raised.

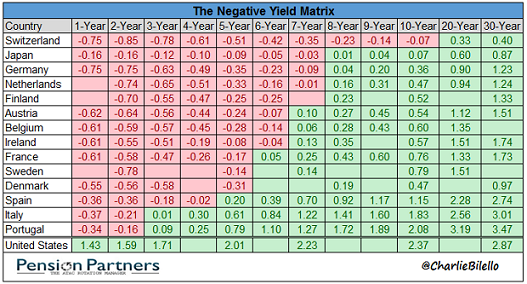

The issue has been that politicians preferred to believe central bank stimulus programmes could solve the deficit by cutting interest rates and printing large amounts of virtually free cash. And unfortunately, when it became clear this policy was failing to work, the banks “doubled down” and pursued negative interest rates rather than admitting defeat:

Leave A Comment