Prompt month November natural gas prices fell a bit less than 2% today as warmer long-range forecasts decreased heating demand expectations.

This did not come as a surprise to our subscribers, as all week we had been watching the potential that long-range forecasts would turn warmer. On Monday we published our Note on the Day explaining that model guidance would likely trend warmer in the South and East through the week, which we have now seen.

This was followed up by a morning Text Alert sent to all Trader level subscribers yesterday morning to watch the $2.92 level.

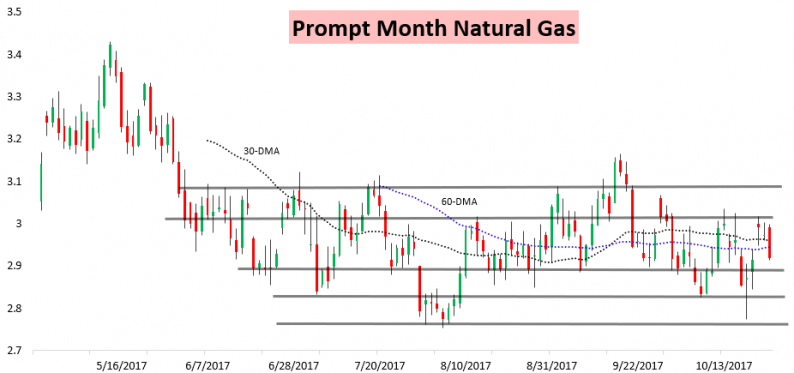

Admittedly, we jumped the gun a bit on that call with the slow trading day yesterday, but we noted the short-term downside was still apparent in our Afternoon Update yesterday despite our view that there could be a quick rally once longer-term forecasts trend colder (and that colder American weather model guidance was propping up the market). We followed this up with our morning text this morning re-confirming the support level that we were watching from $2.88-$2.92 following more bearish runs of American modeling guidance, and the November contract settled right at $2.919 to end the day.

The impact of warming long-range guidance was most apparent near the front of the natural gas strip, with the H/J strip settling at a new seasonal low.

The recent rally in X/Z off medium-term cold also stalled.

The natural gas market thus is clearly awaiting signs of sustained cold but not yet seeing them, and in the meantime we have pulled right back into support. We would expect long-range forecasts to determine whether this support breaks or provides for a bounce off the EIA print tomorrow.

As you can see, our detailed blend of meteorological analysis and natural gas technical/fundamental analysis allows us to easily translate long-range atmospheric trends into actionable ideas within the natural gas market. We expect natural gas prices to be clearly driven by weather in the foreseeable future, and our reports will continue focusing on where the long-range risks are skewed even past what weather models are currently showing.

Leave A Comment