The books have officially been closed on 2017 — both the year and the stock market — and it was a robust year for stocks and a solid one, too, for the Tematica Investing Select List. We’ve had a number of market-beating positions, ranging from Disruptive Technologies investment theme company Universal Display (OLED) that soared more than 205% in 2017, and Cashless Consumption investment theme play USA Technologies (USAT) that rocketed 116% higher since we added it to the Select List in April 2017. We also saw stellar market-trouncing returns in a number of other Select List positions, including Amazon (AMZN), which, as we have said, is the poster-child when it comes to thematic investing given the sheer number of thematic tailwinds at its back.

In 2018, we’ll continue to utilize our thematic lens looking to identify those companies whose business are riding thematic tailwinds and bobbing and weaving potential thematic headwinds. Of course, we’ll need to see sufficient net upside potential vs. downside risk to warrant getting involved. In other words, it will be business as usual.

In order to look forward, we must first see where we’re coming from.

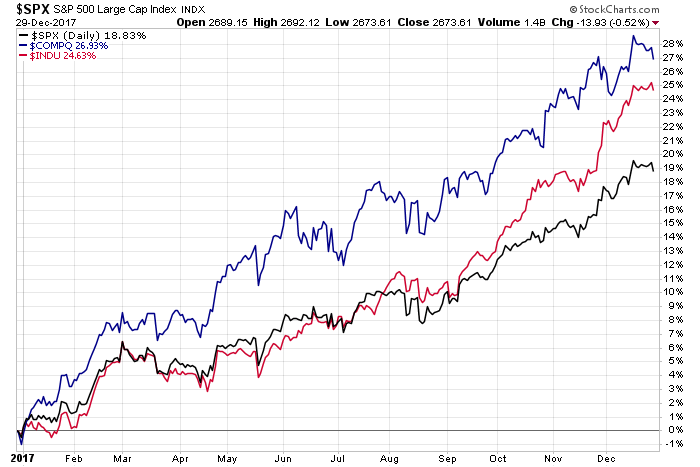

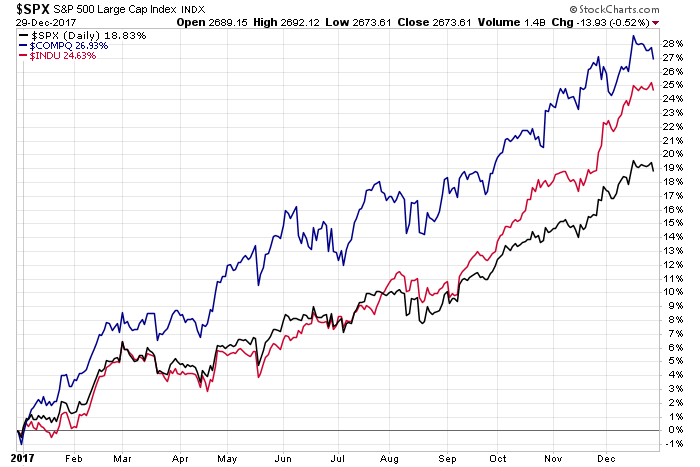

Trading for the last week of 2017 ended on a mixed and somewhat subdued note with no sign of a Santa Claus rally, despite solid consumer spending this holiday shopping season. The Dow Jones Industrial Average, S&P 500, small-cap heavy Russell 2000 and tech-laden Nasdaq Composite Index all finished lower in the last week of 2017. The picture for fourth-quarter 2017 was far more favorable, however, with all the indices well in positive territory. When added to earlier quarterly gains recorded in 2017, the market enjoyed one of its best years ever, with the Dow up 25%, the S&P 500 rising just shy of 20% and the Nasdaq soaring 28%.

In many ways, this leaves the overall market priced to perfection trading at more than 20x expected 2017 earnings for the S&P 500 group of companies. In a few weeks, we’ll start to get a taste of earnings reports for the fourth quarter, but as forward-looking investors, we are already eyeing how stocks and the market are poised to trade on 2018 earnings.

Leave A Comment