My Swing Trading Approach

I spent last week positioning myself, with a set of new long positions to be ready for an eventual bounce that looks to be unfolding today. I may add one additional long position if the rally continues to hold up, but early on, I will be letting my positions that were added on Thursday and Friday do the work.

Indicators

Sectors to Watch Today

Despite Friday’s sell-off, Utilities were not leading the way with Staples. Energy led the way, but still a very problematic sector to play, with more room to fall going forward. Basic Materials appear to be a big bounce candidate, with huge levels of support going back to mid-2017. Staples and Technology, while damaged significantly, will have to be participants in order for the market bounce this morning to be sustained.

My Market Sentiment

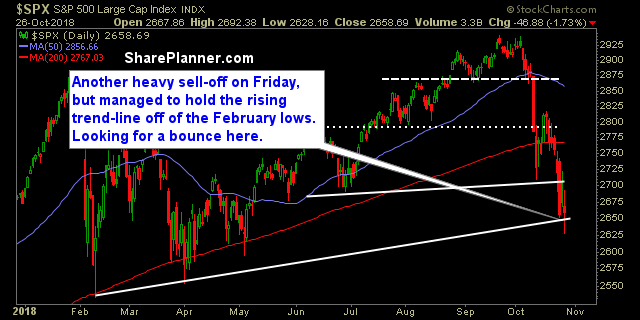

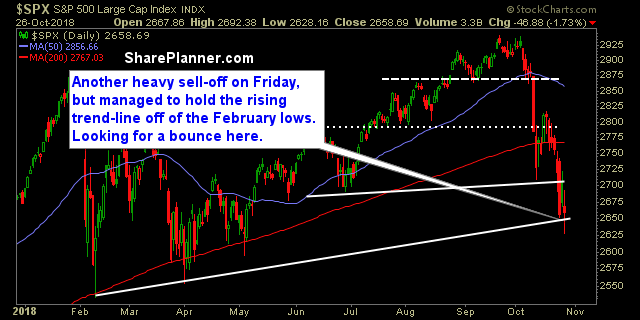

The buyout of RHT by IBM, followed by a key test and hold on Friday of the rising trend-line off of the February lows, sets up for a bounce today. Legitimate kick-back rallies should last at least 3-5 days before running out of gas. I would suspect this one would, at least, retest the 200-day moving average.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment