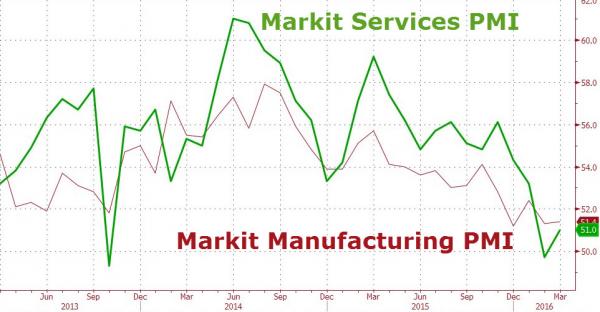

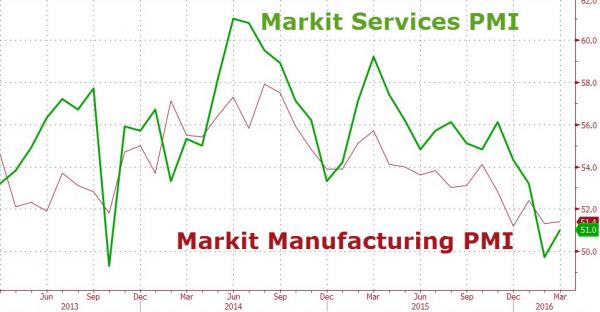

Having blamed the weather for the Services PMI collapse into contractionary levels in February, the very modesty rebound (from 49.7 to 51.0) is a big let down: “The lack of a strong rebound in service sector activity in March is a big disappointment, as bad weather had been blamed for part of the weakness in the first two months of the year.” Indeed, confidence remains subdued and as Markit warns “The US economy is going through its worst growth spell for three and a half years…and the worst may be to come as the greatest concern is the near-stalling of new business growth.”

The average reading for the first three months of 2016 (51.3) revealed the slowest quarterly pace of expansion since Q3 2012.

Commenting on the flash PMI data, Chris Williamson, chief economist at Markit said:

“The US economy is going through its worst growth spell for three and a half years.

“The lack of a strong rebound in service sector activity in March is a big disappointment, as bad weather had been blamed for part of the weakness in the first two months of the year.

“Combined with the lacklustre performance seen in manufacturing, the subdued services survey points to the weakest quarterly expansion of the economy since the third quarter of 2012. The PMI surveys suggest the economy grew at a worryingly meagre 0.7% annualised rate in the first quarter.

“Worst may be to come. The greatest concern is the near-stalling of new business growth. Demand for goods and services is growing at the slowest rate seen this side of the global financial crisis. It’s not surprising therefore that companies lack pricing power, as reflected in a near-stagnation of average selling prices in recent months.

One positive is that the rate of hiring remained impressively resilient, signalling another month of 200,000 non-farm payroll growth in March. However, such strong hiring at a time of weak output growth suggests productivity is trending down at the fastest rate seen over the past six years.”

Leave A Comment