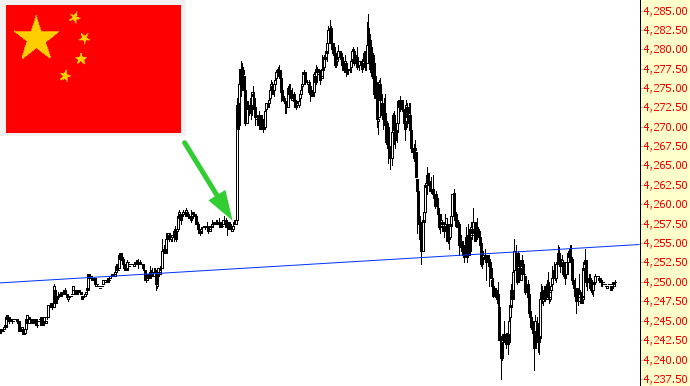

While recession has returned to Japan and interest rates have dropped to negative, in Europe the ECM has effectively announced it will expand its balance sheet again by a trillion Euro. China has lowered interest rates showing this view of

November 22, 2014