USD/CHF: With USD/CHF reversing almost all of its past week losses to close marginally lower on Friday, risk of further move higher is likely. On the upside, resistance lies at the 0.9762 level with a breach targeting the 0.9800 level.

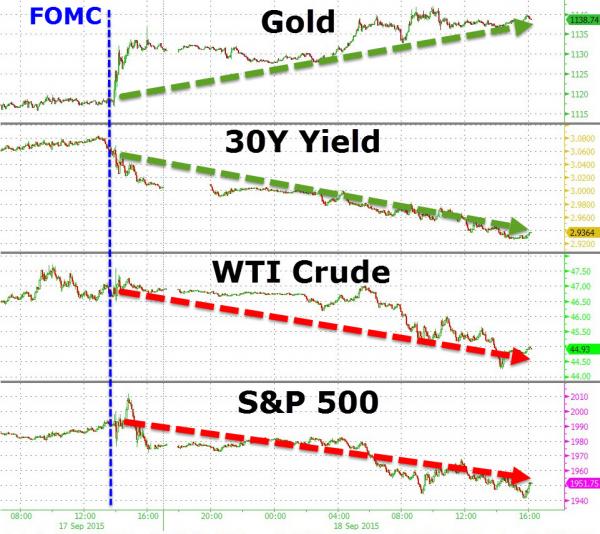

September 18, 2015