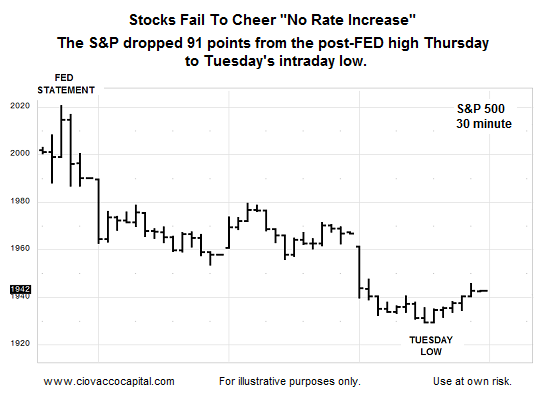

Tuesday featured heavy selling reversing Monday’s light volume rally. Sell day’s volume continues to overwhelm previous light volume rallies. The conclusion is “distribution” or “getting out” of markets is pervasive. Another way of putting this is perma-bulls are wasting their

September 22, 2015