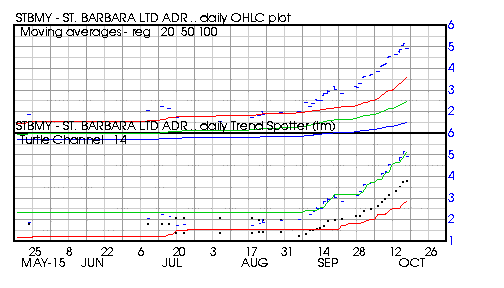

TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence. Today I added St. Barbara (OTCPK:STBMY), Montea Porcupine Mines (OTCPK:MPUCF),Federal National Mortgage Services (FNMAI), Great Rock Development (OTCPK:GROC) and Primo Water (NASDAQ:PRMW) to the Barchart Van Meerten Speculative portfolio

October 19, 2015