2015 has been an ‘odd’ year. Typically this time of year sees demand picking up amid holiday inventory stacking and measures of global trade such as The Baltic Dry Index rise from mid-summer to Thanksgiving. This year, it has not. In

November 6, 2015

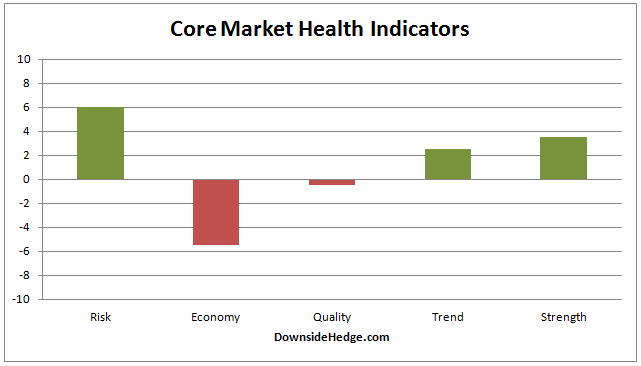

Should you buy stocks or not? Exchange-traded funds (ETFs) are a wonderful invention. Sure, they provide low-cost, tax-efficient alternatives to other types of collective investments but they are also easily observable indicators of market sentiment. If you look at a

Last week, I read a disturbing article on the state of retirement savings. Kate Davidson’s Wall Street Journal piece was based on a recent survey conducted by BlackRock. The survey revealed some bleak statistics about “pre-retirees” in the U.S. (age 55-64). Average retirement savings: $136,000 Expected