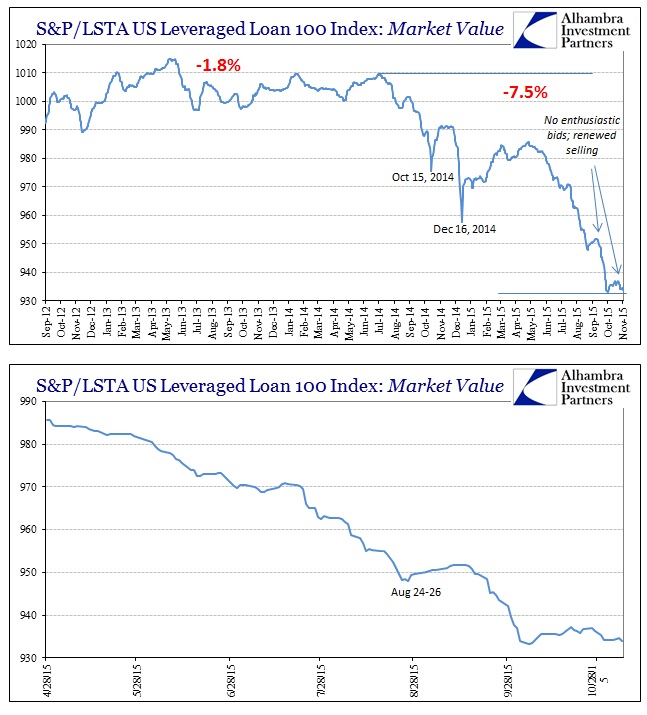

While the stock market had one of its best months in years, it was, like the jobs report, uncorroborated by almost everything else. The junk bond bubble, in particular, stands in sharp and stark refutation of whatever stocks might be incorporating,

November 6, 2015