With the price of oil dropping more than 20% during the third quarter, CVX and XOM were both battered and more investors wondered if their dividends were safe. While each stock has recovered over 20% from its low reached in late August, the risk profiles of these oil giants are different. XOM remains one of our top dividend stocks, but we continue evaluating both businesses and the safety of their dividends.

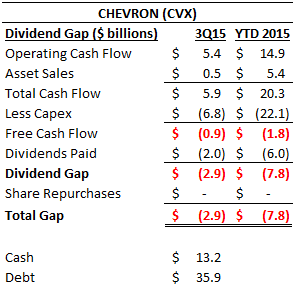

Let’s start with CVX. As seen below, CVX has failed to generate free cash flow this year, losing $1.8 billion YTD (-$7.2 billion, excluding asset sales). Including total dividend payments of $6 billion, the company’s cash drain has been $7.8 billion YTD.

Source: Simply Safe Dividends

If nothing changed, CVX’s cash balance ($13.2 billion) could continue funding the dividend for about the next year before running out of funds. CVX is pulling several levers to keep the dividend alive, including debt issuance ($8 billion YTD), additional asset sales (another $5-10 billion targeted through 2017), capex reductions (down 15-20% this year and another 25% next year), workforce reductions (laying off 10% of its employees), and production volume growth (production to grow by 15-20% from 2014 to the end of 2017 from existing projects).

Many investors were pleased to hear the company’s CEO reiterate his commitment to the dividend and reaffirm his expectation that CVX’s free cash flow will be able to cover the dividend by 2017, which would represent a substantial improvement from today’s coverage. When this claim was initially made, it was based on the assumption that oil prices would average around $70, not the $50 they trade at today.

To make the numbers continue to work, CVX will significantly cut its capex, targeting a 25% reduction in 2016 after a 15-20% slash this year. The company also announced it will lay off around 10% of its total workforce. These are pretty drastic measures for a company of CVX’s size to take and, when coupled with the firm’s lack of dividend increases for the last seven quarters, underscore the severity of the headwinds that CVX faces.

We do not think investors should take CVX’s 2017 target for granted – there is plenty of execution risk involved here. The company now expects capex of $20 to $24 billion in 2017 and 2018. Using $22 billion capex as a midpoint and assuming the dividend amounts to about $8 billion, CVX would need to generate at least $30 billion in operating cash flow compared to its current pace of $21 billion YTD. If production growth boosts cash flow by 15% ($3.2 billion), a $5.8 billion hole remains that will need to be filled by asset sales, further capex reductions, cost cuts, debt, or higher oil prices. While the dividend looks safe for at least the next 1-2 years, oil prices eventually need to rise for CVX to continue its dividend and return to sustainable earnings growth.

It also seems like CVX is trading off long-term growth opportunities for near-term dividend protection given the major capex cuts. During its Q3 earnings call, the company moderately reduced its 2017 production guidance, reflecting potential for major capex cuts to impact production rates. Less than two years ago, CVX expected 2017 capex of $40 billion, nearly double its projection today. While this might help its credibility the next few years by protecting the dividend, it could prove to be a rather poor business decision beyond 2018.

Leave A Comment