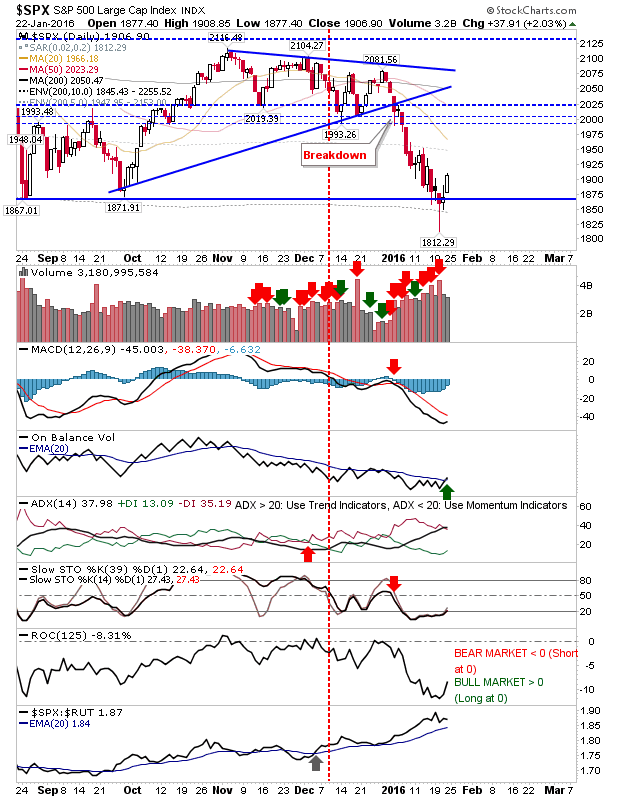

Two Fridays ago (1/15/2016) I highlighted sentiment readings often associated with an oversold equity market. Two days later, Wednesday of this past week, the S&P 500 index bottomed and staged a turnaround, generating its first weekly gain of the year,

January 24, 2016

Donald Luskin writes in the Wall Street Journal: The global economy is slipping into recession. The evidence is showing up in all the usual ways: slowing output growth, slumping purchasing-manager indexes, widening credit spreads, declining corporate earnings, falling inflation expectations, receding