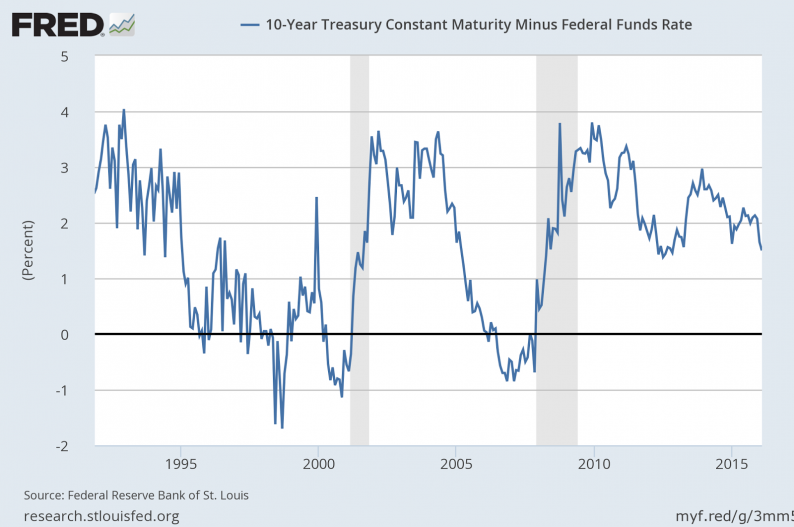

If the US or the Eurozone entered a recession this year, a few macroeconomic variables would look very different relative to previous recessions. 1. The Yield curve would be very steep. Unlike in any previous recession when the yield curve

February 4, 2016

How Did the Stock Market Do Today? Dow Jones: 16,416.58; +79.92;+0.49% S&P 500: 1,915.45; +2.92; +0.15% Nasdaq: 4,509.56; +5.32; +0.12% The Dow Jones Industrial Average today (Thursday) gained 79 points ahead of tomorrow’s critical January jobs report. Markets received a strong boost from materials stocks, which