Believe it or not, one of the biggest victims of falling energy prices has been the recycling industry. The problem is that, from a bottom line perspective, recycling doesn’t always make economic sense when commodities are cheap. Take Waste Management Inc. (WM),

February 20, 2016

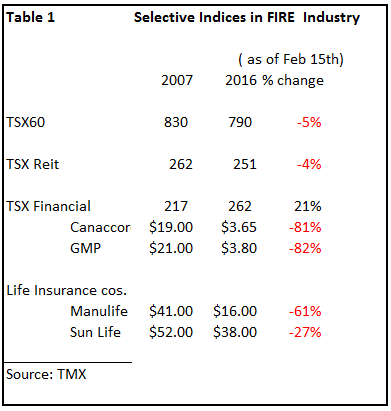

The worldwide collapse in commodity prices is now working its way through the financial markets in Canada. Canada is just now experiencing fundamental changes in the financial community, the sector better known as F.I.R.E. (Finance, Insurance and Real Estate). This sector accounts for approximately 20% of national