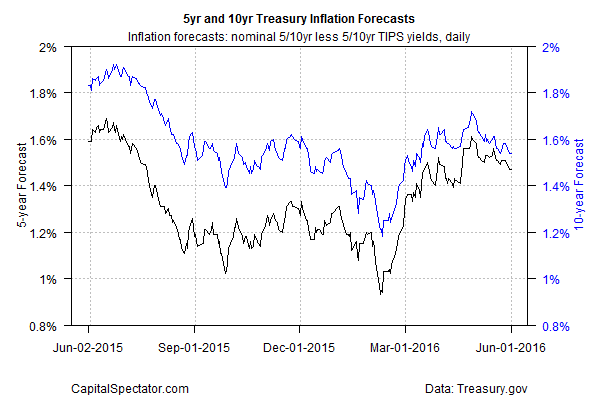

The Federal Reserve is considering another rate hike, perhaps as early as this month, but the Treasury market’s estimate of future inflation signals skepticism from the vantage of government bond traders. The implied forecast, based on the yield spread between

June 2, 2016