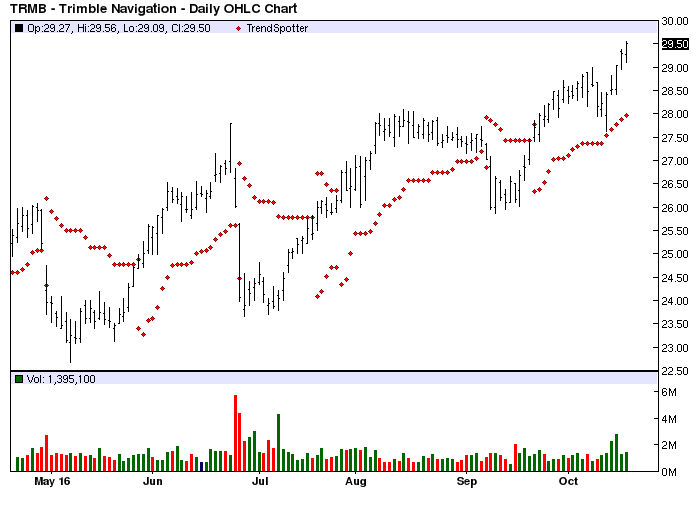

The Chart of the Day belongs to Trimble Navigation (Nasdaq: TRMB). I found the electronic devices stock by using Barcart to sort the Russell 3000 Index stocks first by the highest number of new highs in the last month, then again for technical buy signals of 80%

October 19, 2016

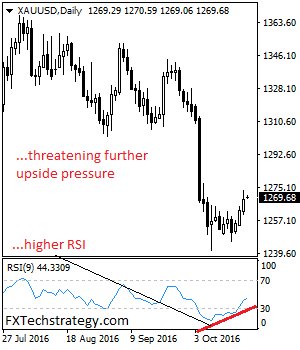

Outside, perhaps we do see a double rainbow (yesterday’s commentary). Inside, though, a solar powered glow-in-the-dark Rallysaurus has resurrected. On September 25th, nearly a month ago I asked, “Have sustainable or renewable energy instruments finally bottomed?” Today, First Solar’s (FSLR) price rose