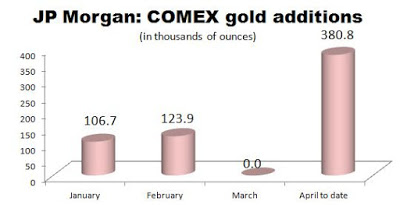

JP Morgan, apart from being an active trader in precious metals futures, has been also aggressively accumulating gold and silver bullion this year. Look at the bank’s precious metals holdings at the COMEX: Interestingly, the bank has been particularly active

April 14, 2017