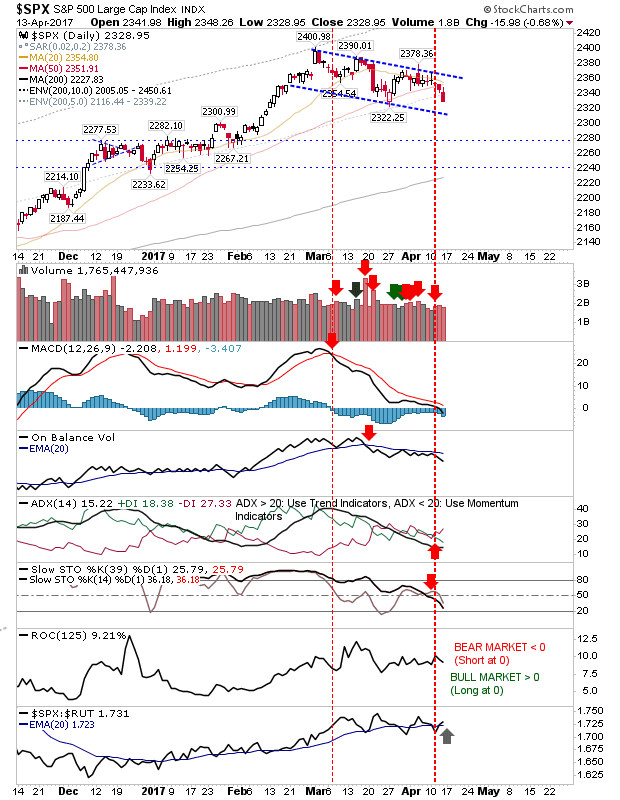

With markets shut on Good Friday, even as the one-two knockout punch of the worst monthly core CPI print in 7 years hit… … coupled with a miss in March retail sales, which suffered their biggest two month drop

April 16, 2017

from The Conversation — this post authored by Graham White, University of Sydney The Fair Work Commission is considering whether to increase Australia’s minimum wage. The Australian Council of Trade Unions is arguing for a A$45-a-week rise. Industry, arguing that currently business has limited ability to