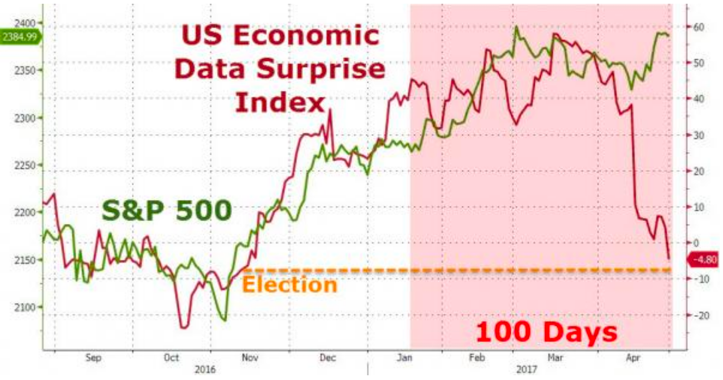

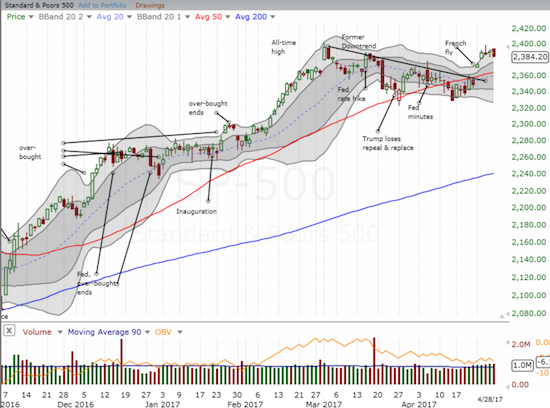

Every silver lining has its cloud and that’s something the forecasters so sure the FANG-style leadership can prevail with extended upside, now have to factor into their excessive overoptimism for the near-term at least. Some, of course, are not, and

April 29, 2017