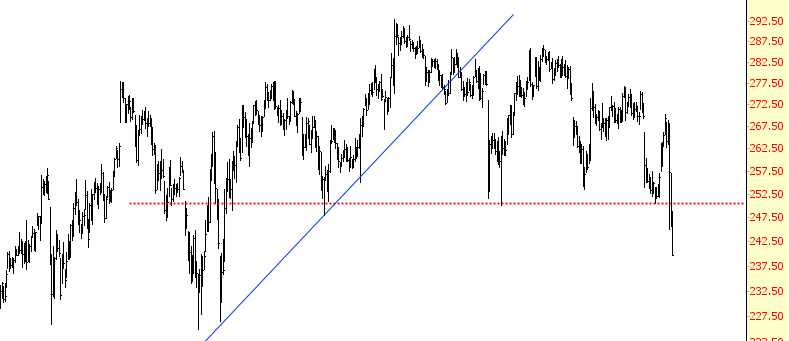

The Chart of the Day belongs to Bio-Rad Laboratories (BIO). I found the medical products stock by using Barchart to sort today’s Top Stocks to Own list first for the most frequent number of new highs in the last month, then again for technical buy signals

May 1, 2017