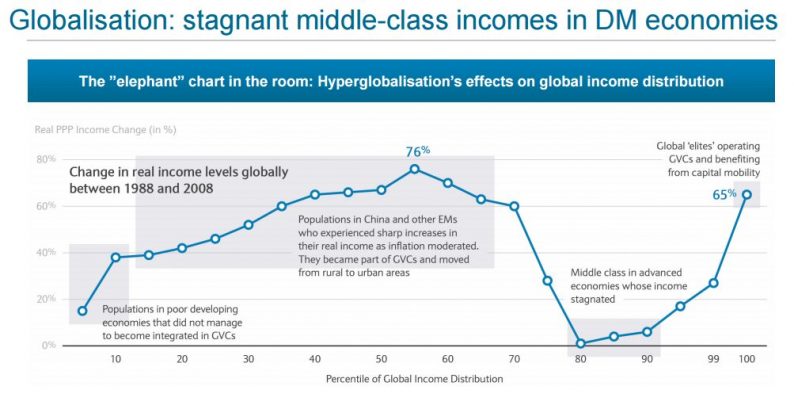

How does one explain the current political divide? In part, this is done by looking at winners and losers in the process of globalization, a recent Barclays report noted. “The middle class in advanced economies whose income stagnated.” In fact, those

July 9, 2017