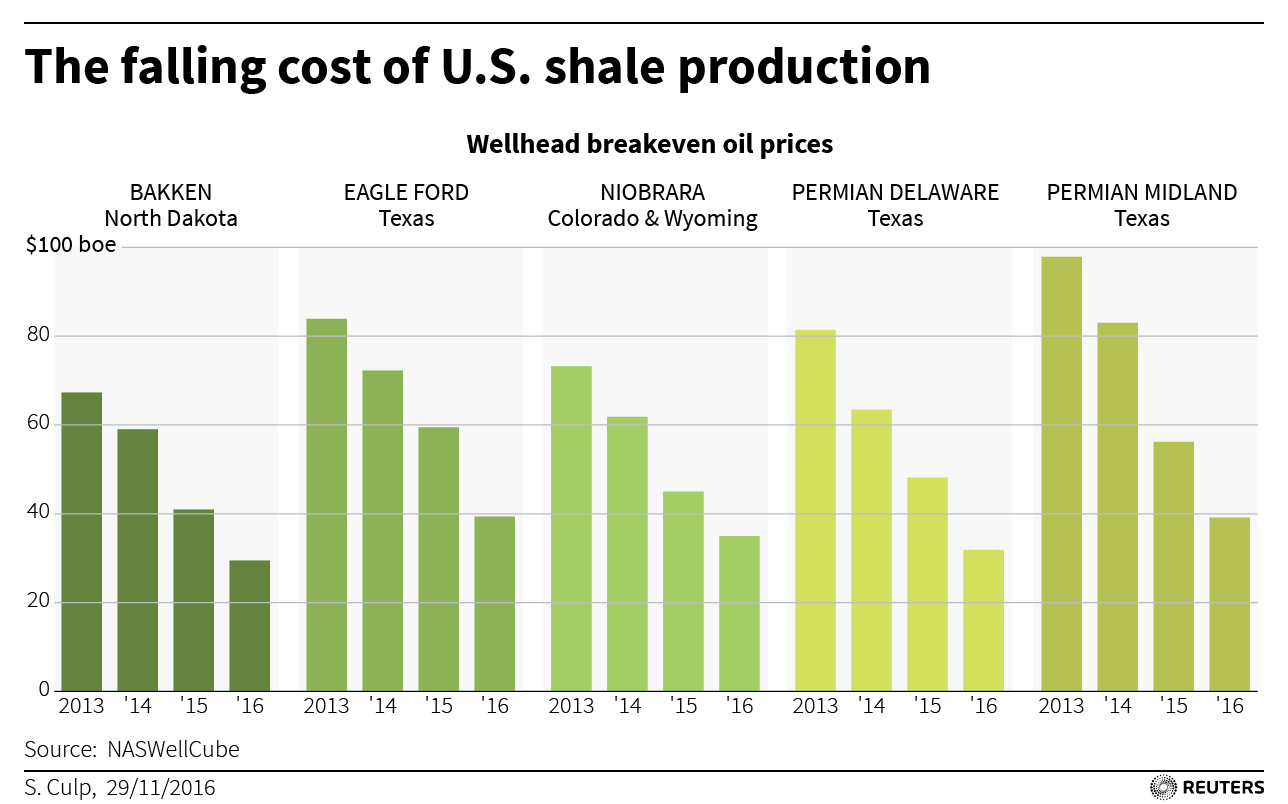

The oil price war between OPEC and the U.S. drove out oil producers who could not keep up with low prices. However, it also led to the development and implementation of more efficient technologies for those who remained, which in turn drove production prices down.

Breakeven points were reduced and countries like the U.S. became competitive with production costs that had only ever been seen before in the Middle East. Oil prices were at a high of $142 in June of 2008. Constant spikes in prices led to an increment in U.S. oil deposits exploted, which in turn resulted in an oversupply. This drove prices down in the summer of 2014 when Brent prices went from USD$116 per barrel in June of 2014 to USD$27 in February of 2017.

Since then Saudi Arabia has tried to drive producers out of the market by keeping prices low.

However, that has not happened yet for the suppliers who have been able to reduce operating costs and increase well productivity during these times. They have implemented new technologies and more efficient machinery to be able to compete with an oversupplied and underpaid market. For example, as mentioned in a publication by the Institute of Energy Research

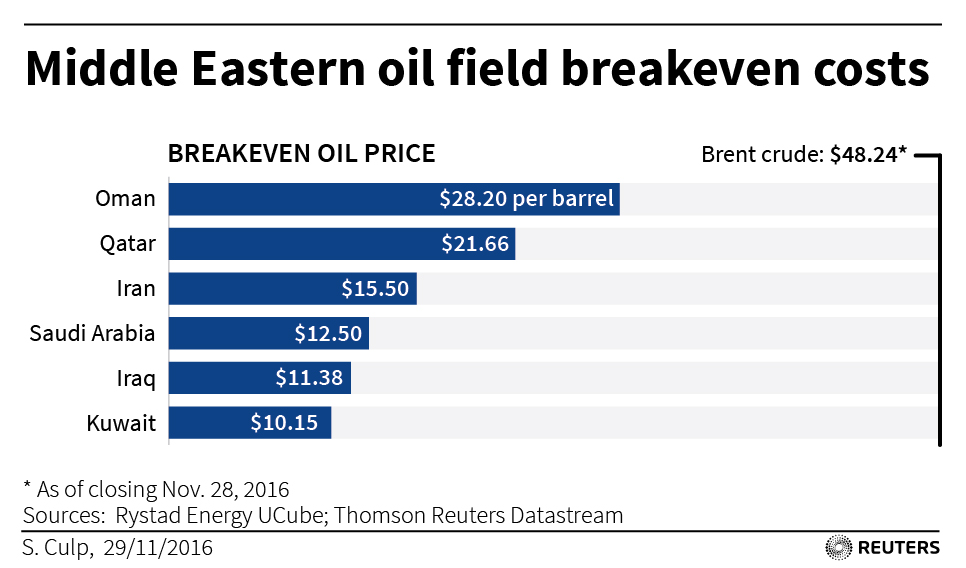

, in the U.S. shale oil basins’ costs are now competitive with those from the Middle East, ranging between USD$11 – USD$15.50 per barrel in the lowest cost fields. As seen in the graph below from Reuters

, the lowest cost U.S. shale production areas compete with the lowest Middle East oil fields.

Overall for U.S. production, the average costs are still higher than the Middle East (see graph below), but the cost reduction curve is steep and the average costs are likely to continue to decline.

Additionally, in an article published by The Wall Street Journal, Halliburton and Schlumberger state,

“customers are using lasers and other high-tech equipment and data analytics before they drill to make sure new wells deliver the most crude for the buck.”

Leave A Comment