Becton, Dickinson and Company (BDX – Free Report) , popularly known as BD, reported fourth-quarter fiscal 2017 earnings of $2.40 per share, which beat the Zacks Consensus Estimate of $2.38 and increased 13.2% on a year-over-year basis.

The company registered revenues of $3.166 billion, down from $3.231 billion in the year-ago period. Revenues, however, beat the Zacks Consensus Estimate of $3.136 billion.

Quarterly Details

The BD Medical segment generated revenues of $2.115 billion, which declined 5.3% from the prior-year period. The segment’s results reflect an adverse impact from the change in the U.S. dispensing business model.

The BD Life Sciences segment generated revenues of $1.051 billion, up 5.5% from the year-ago quarter. The segment’s performance reflects strong numbers across the Biosciences, Diagnostic Systems and Preanalytical Systems units.

U.S. Revenues were roughly $1.644 billion, down 5.9% on a reported basis but up 2.1% on a comparable basis.

International revenues rose 2.6% to $1.522 billion. However, comparable, currency-neutral basis revenues rose 6.9% on the back of solid growth across the company’s businesses.

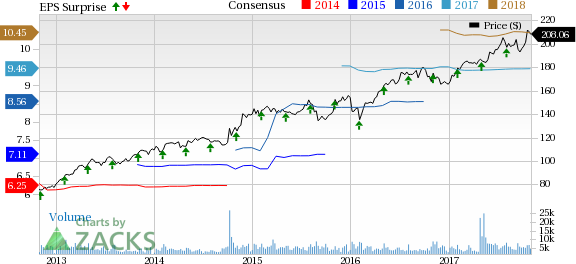

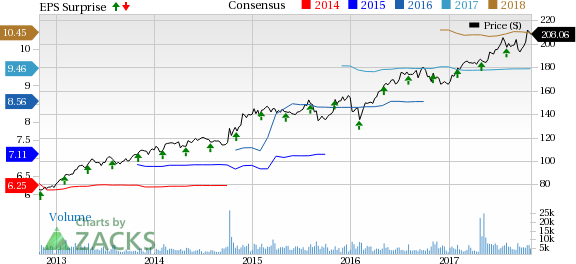

Becton, Dickinson and Company Price, Consensus and EPS Surprise

Becton, Dickinson and Company Price, Consensus and EPS Surprise | Becton, Dickinson and Company Quote

Guidance

The company expects fiscal 2018 revenues to increase 5% to 6%. The company expects adjusted earnings per share between $10.55 and $10.65 on a stand-alone basis, which represents growth of approximately 12%.

Zacks Rank & Key Picks

Becton, Dickinson currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical sector are PetMed Express, Inc. (PETS – Free Report), Luminex Corporation (LMNX – Free Report) and Intuitive Surgical, Inc. (ISRG – Free Report). Notably, PetMed and Luminex sport a Zacks Rank #1 (Strong Buy), while Intuitive Surgical carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Leave A Comment