If you were following along last week, you know that more than a few commentators believe rates and the dollar have simply priced in too much pessimism around the U.S. economy and the fiscal outlook. No, the incoming data hasn’t

September 2, 2017

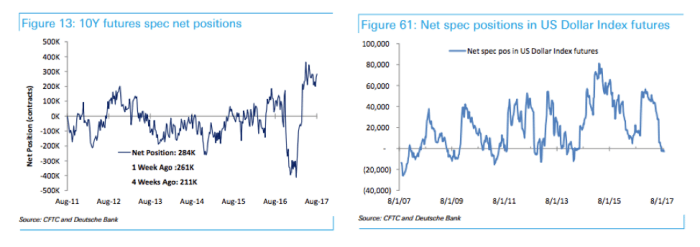

Fundamental Forecast for the US Dollar: Neutral US Dollar impressively resilient after disappointing employment data Recent weeks hint USD more responsive to positive vs negative news Services ISM, Beige Book, Fed-speak may help greenback recovery The US Dollar continues to impress with its resilience

Deals and Financings Berry Genomics (SHZ: 000710), a Beijing diagnostics and sequencing company, completed its $648 million reverse merger that lists the company on the Shenzhen exchange (see story). Berry merged into a company formerly known as Chengdu Tianxing Instrument & Meter, but the company’s