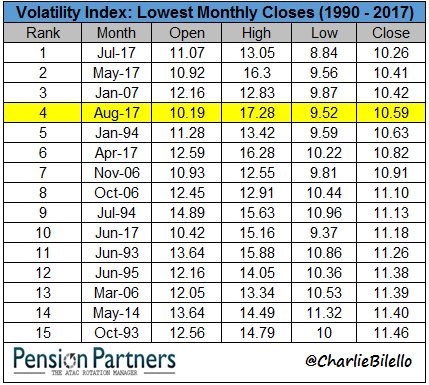

By RCM Alternatives Eighty-nine percent of futures markets experienced a contraction of volatility in the first six months of 2017, which translates to a lack of trends for typical systematic Managed Futures managers for find Alpha from. Don’t look now

September 2, 2017