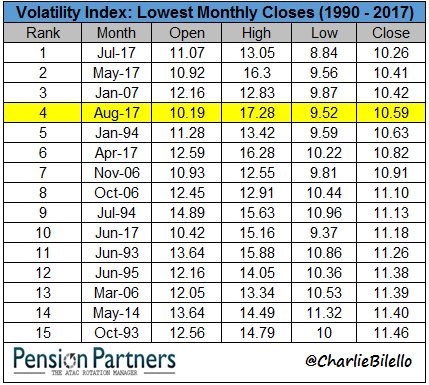

The stock market ended the month of August positive making it the 10th straight month the S&P 500 was up on a total return basis. In the past two days, it seemed like someone wanted the market to be up for the month as it rallied just enough to achieve that goal. The last North Korean action did nothing to stymie the market as the S&P 500 is within 1% of its all-time high. The VIX fell 5.61% to close the month at 10.59. As you can see from the chart below, this was the 4th lowest monthly close for the VIX since 1990. As you can see, the high is the highest on this list because of the brief worry about North Korea.

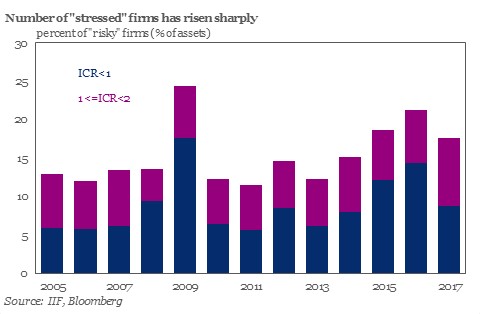

Some stats don’t match the great conditions large cap corporations are in. That’s because the small caps aren’t having the same earnings expansion. The chart below shows the percentage of firms which have low interest coverage ratios. These ratios will be an issue when interest rates rise. The majority of the firms seeing low ICRs are small caps. This explains why the 2017 bar is the third highest in this bull market even though S&P 500 earnings are at a record.

The chart below shows that 8 of the top 13 firms by market cap are tech stocks. Even more remarkable, 7 of the top 8 firms are tech. The interesting thing about these mega cap tech names is if you tried to separate the tech sector it would be tough to figure out how to categorize them because they have their tentacles in so many business lines. For example, Amazon is an online retailer, a brick and mortar super market company, a tablet and e-reader company, and a cloud company.

Apple looks like the riskiest of the firms on this list because the company relies mostly on the iPhone. Apple needs to convince consumers to buy their new phone which will have the technology which Android phones have had for a few months. The distinguishing feature of the new iPhone will be the infinity screen which many of the cheaper Android phones already have. The question is how many new product launches will Apple be able to rely on having an increased screen size. Besides beating the competition, Apple needs to make sure old users constantly upgrade their phones every 1-2 years despite their useful life being longer than that. In the long-term Apple appears to have a shallow moat, meaning it’s tough to defend its market share. The other aspect to keep in mind is you don’t want to get excited about the new innovations such as self-driving cars because it will be nearly impossible to make up for iPhone sales declines if they occur. The iPhone is the most profitable product in history; it’s tough to have lightning strike twice.

Leave A Comment